Last week the General Register Office for Scotland released figures that showed Scotland’s population had reached a record high (although the growth rate, far from breaking any records, has slowed). The population overall continues to age, but births have increased and Scotland has attracted net migration both from the rest of the UK and from the rest of the world.

Human capital is likely an important determinant of long-term economic success, since labour is obviously an input into production. Conversely, relative productivity is likely an important determinant of the direction of net migration and other demographic statistics: we could imagine that a small open economy offers a wage conditional on productivity of other factors, and attracts a corresponding labour force to equalise marginal product of labour; and therefore net migration flow indicates higher productivity of these other factors. Whether economic success determines relative demographics or vice versa, these statistics clearly co-vary and looking at the outcome of relative migration can tell us about the outcome of relative economic performance.

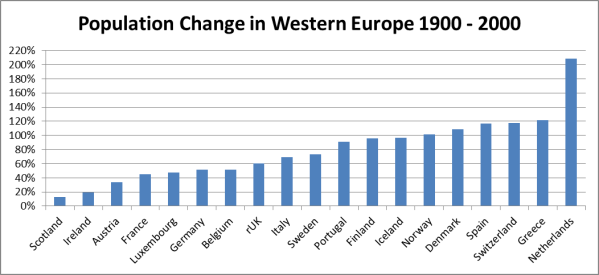

Over the 20th century, Scotland did terribly on net migration and population growth[1] (though somebody has to be at the bottom!). The closest “challenger” to Scotland was Ireland who can be said to share an “emigration technology” with Scotland as regards emigration to USA/Canada/Australia/New Zealand: the English language. Scotland’s population growth was worse than Ireland’s, and much worse than rUK’s – who also shared this English language “technology”, and who should have shared the same government policy framework. Within UK now, approximately 800,000 Scots live in rUK against on approximately 400,000 from rUK living in Scotland.

However, since 1999 Scotland has done better: in particular net flows across the Scotland-England border are now approximately balanced[2], and Scotland reversed its population decline with in-migration from Eastern Europe over 2000-10. Last week’s statistics demonstrate that in-migration remains favourable.

Is Scotland’s improved demographic performance related to achieving limited self-government with the advent of devolution in 1999? Is this a spurious association? Does it indicate that there was poor economic governance up until devolution, but that we are now in an optimum arrangement? Or perhaps it indicates that control over institutions is beneficial, and more control (e.g. independence) would be even more beneficial?

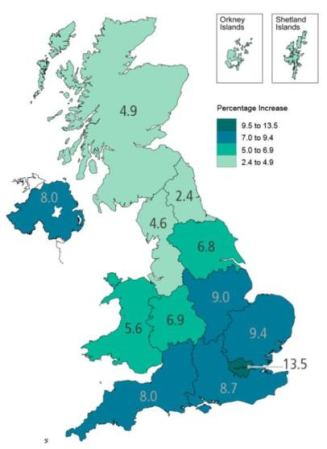

The Office for National Statistics map of UK population increase[3] can be read in support of the interpretation that proximity to power is related to population growth (and presumably also to net migration, and to relative economic performance). The fall-off in the rate of population increase as distance from London increases is evident (high fertility in Northern Ireland excepted), and perhaps Holyrood is the only reason for Scotland’s rate being above that of the North West and North East of England? Interestingly it is also the case that, within Scotland, Edinburgh and the east saw population increases, while population fell in the west.

First posted at http://esrcscotecon.com/2013/08/11/population-records/#more-433

[1] Country data from GapMinder, Scottish data from Wikipedia (rUK = UK – Scotland). [2] Chart 4.09 Fiscal Commission WG http://www.scotland.gov.uk/Resource/0041/00414291.pdf [3] As tweeted by the BBC’s Mark Easton

[1] Country data from GapMinder, Scottish data from Wikipedia (rUK = UK – Scotland). [2] Chart 4.09 Fiscal Commission WG http://www.scotland.gov.uk/Resource/0041/00414291.pdf [3] As tweeted by the BBC’s Mark Easton