# Brilliant: Northern Powerhouse relocated to London

# UK’s high-wire act on power supplies laid bare says the FT. Amazing given the reductions in renewables subsidies and the end of the CCS competition, the prioritisation of new nuclear capacity which has extremely long development timescales, and the fact that the transmission charging regime is directly causing the early closure of generation capacity like Longannet.

# At some point in the near future (hopefully) the Commission on Local Tax Reform will publish it's report (cue another self-aggrandising link to my own contribution: The Opportunity for Land & Property Taxes in Scotland). On this topic, I was reiterating the political economy aspects at ScotFES which I think are backed up by the results of the survey run by the Commission which unsurprisingly shows that the general public lean towards income taxes; Brian Ashcroft, in Business rates and the Scottish economy, makes the point that Business Rates optimally should not tax the buildings element - they should face a pure land value tax - but also that lobbyists really should not be listened to!

# I love the whimsical scenarios economists use to clarify thinking. Nick Rowe has a good example this month with "Vortigern's immigration policy", and the most famous example is likely Krugman recounting the tale of the Babysitting Co-op to explain countercyclical monetary policy. I was reminded of this recently by a decent post, which was followed by a dreadful argument in the comments, on the GERS figures, on the Scot Goes Pop blog. The author tries to use analogy to explain his ideas (and does a reasonable job I think) but this is clearly laughable in the eyes of his detractors, for whom I imagine the world is a blinding mess of facts, and expertise involves knowing the detail of all these facts (rather than cutting straight through to an understanding of the main points, by being able to simplify and realise what's important and what's not).

# Interesting article in Washington Monthly on trends in American regional inequalities:

"a story of incomes converging across regions to the point that people commonly and appropriately spoke of a single American standard of living. This regional convergence of income was also a major reason why national measures of income inequality dropped sharply during this period. ... Few forecasters expected this trend to reverse, since it seemed consistent with the well-established direction of both the economy and technology. With the growth of the service sector, it seemed reasonable to expect that a region’s geographical features, such as its proximity to natural resources and navigable waters, would matter less and less to how well or how poorly it performed economically. Similarly, many observers presumed that the Internet and other digital technologies would be inherently decentralizing in their economic effects. Not only was it possible to write code just as easily in a tree house in Oregon as in an office building in a major city, but the information revolution would also make it much easier to conduct any kind of business from anywhere. Futurists proclaimed “the death of distance.” Yet starting in the early 1980s, the long trend toward regional equality abruptly switched. Since then, geography has come roaring back as a determinant of economic fortune, as a few elite cities have surged ahead of the rest of the country in their wealth and income. ... Adding to the anomaly is a historic reversal in the patterns of migration within the United States. Throughout almost all of the nation’s history, Americans tended to move from places where wages were lower to places where wages were higher. ... But over the last generation this trend, too, has reversed. Since 1980, the states and metro areas with the highest and fastest-growing per capita incomes have generally seen hardly, if any, net domestic in-migration, and in many notable examples have seen more people move away to other parts of the country than move in. Today, the preponderance of domestic migration is from areas with high and rapidly growing incomes to relatively poorer areas where incomes are growing at a slower pace, if at all."

The explanation offered in the article for these these trends is policy which either allows or restricts monopolies: "Throughout most of the country’s history, American government at all levels has pursued policies designed to preserve local control of businesses and to check the tendency of a few dominant cities to monopolize power over the rest of the country." - this rings true as the likely driver of similar trends in the UK too.

An alternative explanation, which again rings true but probably has less UK relevance (because almost everywhere in the UK is a "closed market") is that offered by Idiosyncratic Whisk: "We had two housing markets - a closed market where there was massive price appreciation, and an open market where there was healthy expansion of the real housing stock. ... the added gross income for the highest income cities frequently goes to housing expenses."

# Some more links on geographical mobility, inequality and housing

- Housing supply, rents, and economic mobility from the Washington Centre for Equitable Growth

- Britain's debate on social mobility is stuck. It's time for a city perspective from CityMetric/Centre for Cities

- Low Interest Rates, the Housing Supply Constraint, and Picketty's Concern from Idiosyncratic Whisk

# In Automatic Destabilizers, Idiosyncratic Whisk makes a great point about tax design. A good system would encourage investment when factors were abundant and wages and interest rates were low. But the fact that corporate losses can be offset against tax means that corporations face their highest tax burden at the start of a downturn (when they don't have any losses to offset), exactly when expectations of future (medium term) consumer demand is falling, therefore when their investment demand even in the absence of tax disincentives is low, and at the same time as interest rates and wages are falling, and unemployment is rising. Conversely, corporations face their lowest tax burden at the start of a boom because at this point they have a deferred tax asset which offsets their tax payments - but at this point their expectations of future consumer demand is high and so their investment demand before tax incentives is is high anyway, and they are competing for relatively scarce and expensive labour and investment capital. This is a pro-cyclical, destabilising, tax design.

# I've started a new project - just to get into the habit of looking at data, even when I don't have any particular reason to. U.S.E. (Understanding the Scottish Economy) will summarise Scottish economic data, and posting will likely be on a monthly basis. The first post is now up: November 2015 Data Release Summary.

Tuesday 1 December 2015

Thursday 5 November 2015

End October Links

Slightly late with the end of the month links this month...

# Chris Dillow makes a good point in Trident & the limits of rationality: "I'd expect people who disagree about the case for Trident to differ in other ways. I'd expect advocates of Trident to be more risk- and ambiguity-averse than its opponents: if they are keener to buy nuclear insurance they should also be keener to buy other forms of insurance and be less inclined to gamble or invest in equities. Empirically, though, this seems doubtful." This rings true - and cuts both ways. An argument within climate change economics is about whether the cost is small or large: it's small if you assume the world continues to grow and that the impacts occur a long time from now, because a relatively small investment made now will accumulate nicely to pay out at the same time as the future loss; but the cost is large (willingness to pay to avoid the risk is approaching 100% of GDP) if it's the insurance value against civilisational collapse or human extinction (at which point we have infinite marginal utility, see Weitzman (2009)). So there should be a positive correlation between your support for nuclear weapons and your support for strong climate change action? I don't think so! I expect the nuclear supporters are not so keen on climate change action, and I'm certainly all for spending the £100bn Trident replacement-cost on zero carbon energy infrastructure!

# In discussing John McDonnell's suggestion for regional members of the MPC of the BoE, Tony Yates says "This would be a retrograde step. Multiple committee places should be there to allow for controversies to play out about the appropriate diagnosis of the aggregate economic state, and the aggregate monetary policy. And they should not be there to set up a tug of war between regional members trying to tilt interest rate decisions towards their own regions.". I think this misses the point: I would hope that there would not be any systematic difference in the advice offered by regional members, but the fact that they were based somewhere else might reduce groupthink and widen the perspectives that were brought to the MPC. And indeed, Tony Yates almost brings up this point: "the regionalism [in the USA] is not really regionalism anyway. The multiple local Feds, in my view, mostly serve as a way to generate competing talent pools that produce potential FOMC members." - if the proposed regional members of the MPC were from offices of the BoE that each provided a proportional share of the BoE's analytical capability, then the UK's Central Bank would be contributing to building capacity in expertise across the UK (and might lower its costs due to the relative cost of labour and real estate outside of London).

# I recommend this George Monbiot article, Home Ground, and I can use it to plug my new local tax working paper: The opportunity for land & property taxes in Scotland.

"Joan Bakewell, ... argued that it would be “mean-spirited” to encourage “old people living alone in big houses … to sell up and make room for young and aspiring families.” I would argue that holding onto such houses while families are homeless is, in aggregate, far meaner. But she has a solution: “Let them build more houses.” ... Let’s not look back at the profligate use of the space we already possess. Let’s not change the policies that encourage it. Let’s just keep building. It’s like dumping half our food in landfill then demanding that food production rises. ... the idea that building alone will solve the problem is pure fantasy. There are 26.7 million households in the UK. In 2014, 1,219,000 homes were traded. So even if the government were to achieve its aim of building 200,000 homes a year, which some housebuilding experts consider impossible, it would add less than 1% a year to the total stock, and increase the volume of transactions by only one sixth. ... we cannot build our way out of this crisis. If we really want to solve it, the greatest contribution must come from the redistribution of existing stock."

# A further link related to my local tax paper is related to the point that savings directed towards housing may reduce investments in productive capital (and at the same time, due to frictions in the housing market, this leads only to increased land and house prices rather than to expanded supply of housing) at a cost to the level of output that the economy can produce. The BoE discuss changes in pension rules and asks whether the reduced requirements to save for an annuity will lead to a "spending spree". They find that while "greater pension freedom is likely to have only a small impact on household spending. There could be a larger impact on property investment". Aye, cheers very much George.

# VoxEU: The housing cost disease describes a fascinating paper by Borri & Reichlin, linking the relative productivity in production of housing against that in producing the rest of the economy's output, to the increasing Wealth-to-income ratios described by Piketty.

# Chris Dillow makes a good point in Trident & the limits of rationality: "I'd expect people who disagree about the case for Trident to differ in other ways. I'd expect advocates of Trident to be more risk- and ambiguity-averse than its opponents: if they are keener to buy nuclear insurance they should also be keener to buy other forms of insurance and be less inclined to gamble or invest in equities. Empirically, though, this seems doubtful." This rings true - and cuts both ways. An argument within climate change economics is about whether the cost is small or large: it's small if you assume the world continues to grow and that the impacts occur a long time from now, because a relatively small investment made now will accumulate nicely to pay out at the same time as the future loss; but the cost is large (willingness to pay to avoid the risk is approaching 100% of GDP) if it's the insurance value against civilisational collapse or human extinction (at which point we have infinite marginal utility, see Weitzman (2009)). So there should be a positive correlation between your support for nuclear weapons and your support for strong climate change action? I don't think so! I expect the nuclear supporters are not so keen on climate change action, and I'm certainly all for spending the £100bn Trident replacement-cost on zero carbon energy infrastructure!

# In discussing John McDonnell's suggestion for regional members of the MPC of the BoE, Tony Yates says "This would be a retrograde step. Multiple committee places should be there to allow for controversies to play out about the appropriate diagnosis of the aggregate economic state, and the aggregate monetary policy. And they should not be there to set up a tug of war between regional members trying to tilt interest rate decisions towards their own regions.". I think this misses the point: I would hope that there would not be any systematic difference in the advice offered by regional members, but the fact that they were based somewhere else might reduce groupthink and widen the perspectives that were brought to the MPC. And indeed, Tony Yates almost brings up this point: "the regionalism [in the USA] is not really regionalism anyway. The multiple local Feds, in my view, mostly serve as a way to generate competing talent pools that produce potential FOMC members." - if the proposed regional members of the MPC were from offices of the BoE that each provided a proportional share of the BoE's analytical capability, then the UK's Central Bank would be contributing to building capacity in expertise across the UK (and might lower its costs due to the relative cost of labour and real estate outside of London).

# I recommend this George Monbiot article, Home Ground, and I can use it to plug my new local tax working paper: The opportunity for land & property taxes in Scotland.

"Joan Bakewell, ... argued that it would be “mean-spirited” to encourage “old people living alone in big houses … to sell up and make room for young and aspiring families.” I would argue that holding onto such houses while families are homeless is, in aggregate, far meaner. But she has a solution: “Let them build more houses.” ... Let’s not look back at the profligate use of the space we already possess. Let’s not change the policies that encourage it. Let’s just keep building. It’s like dumping half our food in landfill then demanding that food production rises. ... the idea that building alone will solve the problem is pure fantasy. There are 26.7 million households in the UK. In 2014, 1,219,000 homes were traded. So even if the government were to achieve its aim of building 200,000 homes a year, which some housebuilding experts consider impossible, it would add less than 1% a year to the total stock, and increase the volume of transactions by only one sixth. ... we cannot build our way out of this crisis. If we really want to solve it, the greatest contribution must come from the redistribution of existing stock."

# A further link related to my local tax paper is related to the point that savings directed towards housing may reduce investments in productive capital (and at the same time, due to frictions in the housing market, this leads only to increased land and house prices rather than to expanded supply of housing) at a cost to the level of output that the economy can produce. The BoE discuss changes in pension rules and asks whether the reduced requirements to save for an annuity will lead to a "spending spree". They find that while "greater pension freedom is likely to have only a small impact on household spending. There could be a larger impact on property investment". Aye, cheers very much George.

# VoxEU: The housing cost disease describes a fascinating paper by Borri & Reichlin, linking the relative productivity in production of housing against that in producing the rest of the economy's output, to the increasing Wealth-to-income ratios described by Piketty.

Tuesday 3 November 2015

The Opportunity for Land & Property Taxes in Scotland

Lesley Riddoch was on Michael Greenwell's podcast in October discussing land reform. From around 22 minutes in, they discuss the non-development of vacant and derelict land in cities.

"When developers get their hands on land, they land-bank it, so that they can wait ... until they get permission to build high-end residential flats, because that's where the biggest profits are ... Now generally a lot of these areas are not zoned for that ... Developers are hanging out for what will make the most money for them, and in the meantime they have no penalty on it ... You either have to intervene in statutory ways, or you start to impose taxes on land which does it for you."

As an economist, it's no surprise that I favour imposing taxes rather than what's labelled here as statutory intervention. And I have a new working paper that makes the argument for land and property taxes entirely in keeping with the quote above. The paper will form part of the evidence base for a report by the Commission on Local Tax Reform which should be released in the coming months.

The paper makes the case for land and property taxes promoting economic activity - the release of vacant and derelict land being one of the channels for this. The main results of the paper are that a tax on property values, set at a rate to replace the current council tax revenues, would be progressive (i.e. would reduce net household income inequality) and would result in a large majority of the population being better off - so a council tax to property tax policy change should be a vote winner.

"When developers get their hands on land, they land-bank it, so that they can wait ... until they get permission to build high-end residential flats, because that's where the biggest profits are ... Now generally a lot of these areas are not zoned for that ... Developers are hanging out for what will make the most money for them, and in the meantime they have no penalty on it ... You either have to intervene in statutory ways, or you start to impose taxes on land which does it for you."

As an economist, it's no surprise that I favour imposing taxes rather than what's labelled here as statutory intervention. And I have a new working paper that makes the argument for land and property taxes entirely in keeping with the quote above. The paper will form part of the evidence base for a report by the Commission on Local Tax Reform which should be released in the coming months.

The paper makes the case for land and property taxes promoting economic activity - the release of vacant and derelict land being one of the channels for this. The main results of the paper are that a tax on property values, set at a rate to replace the current council tax revenues, would be progressive (i.e. would reduce net household income inequality) and would result in a large majority of the population being better off - so a council tax to property tax policy change should be a vote winner.

Thursday 1 October 2015

End September Links

# Arc of Prosperity asks Did universal bilingualism give Scots an advantage in the past? - I've had this idea ever since I read Billy Kay's The Mither Tongue. It should be possible to examine further (at least to look at correlations if not necessarily causation) by looking at regions of countries which have a lot of bilingualism (e.g. Catalan and Spanish in Catalonia) against regions of the same country which don't.

# The BBC reports on encouraging news from about the potential for a climate deal to include relatively undamaged countries accepting responsibility for those suffering a lot of damage. The article does quote Julie-Anne Richards from the campaign group, Climate Justice, saying that "the current situation being experienced with migrants in the Mediterranean was stiffening the resolve of poorer countries to make sure that an agreement on people displaced by climate change was part of any new deal. Right now if you are a low lying country you'd be looking at the Mediterranean and not having a lot of confidence that your future was guaranteed unless you could get something locked into the Paris agreement that acknowledged that vulnerable countries are going to face the worst impacts". This is an issue that those objecting to taking large numbers of Syrian refugees on the grounds that the solution should actually be to deal with ISIS, are not considering. The proximate cause of the Syria crisis was ISIS, but between 2007 and 2010, Syria had its worst drought in the instrumental record. The social upheaval that allowed ISIS to take control (while obviously helped by 2003 Iraq War) may be related to climate change, consistent with the theory of Yaneer Bar-Yam of the New England Complex Systems Institute who finds links between food prices and revolutions.

# Simon Wren-Lewis links to research showing that Voters respond to the the ‘reported’ rather than the ‘real’ economy with obvious implications to be drawn about the media in terms of their reporting of the 2015 General Election. (I can't help feeling that many of the same points could also be charged at the reporting of the 2014 Independence Referendum though too.) "Voters ... respond to how the economy ... is reported to be. ... the media really matters. ... The discussion of issues involving the economy ... among most of the ‘political class’ is often so removed from reality that it deserves the label myth. ... I do not believe I was exaggerating in suggesting that the ... myth was in good part responsible for the Conservatives winning the election. The media is vital in allowing myths to be sustained or dispelled. That does not mean that the media itself creates myths out of thin air. These myths on the economy were created by the Conservative party and their supporters, and sustained by the media’s reliance on City economists. ... Myths ... do come from real concerns... But who can deny that much of the media ... have stoked that"

# Again on refugees & migration, some cool maps from BigThink and The Independent

# Cereals, appropriability, and hierarchy discusses the neolithic roots of current cross-country differences in economic productivity. In contrast to Jared Diamond (geography determined where high farming productivity and the availability of food surpluses were), it is argued that it is not food surpluses, but rather the appropriability of crops that determines development through the incentives this creates for the emergence of complex social institutions: "increasing returns to scale in the provision of protection from theft, early farmers had to aggregate and to cooperate to defend their stored grains. Food storage and the demand for protection thus led to population agglomeration in villages and to the creation of a non-food producing elite that oversaw the provision of protection. Once a group became larger than a few dozen immediate kin, it is unlikely that those who sought protection services were as forthcoming in financing the security they desired. This public-good nature of protection was resolved by the ability of those in charge of protecting the stored food to appropriate the necessary means."

# This month's CityTalks podcast from the CentreForCities had a great contribution from FT Leader Writer Giles Wilkes on how power breeds success: "We're talking here about incentives ... What mobile businesses want ... is that they're dealing with the local leadership, that is really going to have their interests in mind ... [in the UK outside London, local leaders have little incentive to deal positively with business] and the trouble is that all of this is self-fulfilling: if you want to be, if you're a thrusting, active kind of bureaucrat or politician who wants to get ahead and improve things, you go to Westminster nowadays - that's where the power is, that's where the glory is"

# George Kerevan's article in the National also describes how London's dominance makes it impossible for other locations to get started (on the agglomeration process) in the context of the Green Investment Bank: "a Green Bank ... located in Edinburgh, which has a strong banking infrastructure and is located close to where many big renewables projects were likely to be built. ... Certainly the GIB has its formal HQ in Morrison Street in Edinburgh, next to the Conference Centre. But on enquiring you will discover that the GIB has only 50 of its current 113 staff based in the Scottish capital, handling administrative and backroom functions. The dealmakers are all based in… er, Millbank Tower in London. GIB’s chief executive is Shaun Kingsbury, ... He is based in London, lives in the Home Counties, and commutes to Scotland a couple of days a week. ... Kingsbury argues that putting together funding deals would require his people travelling to the City of London, so it makes sense to have them live there rather than commute from Edinburgh. It is an excuse I’ve heard all my life to justify London’s clammy grip on decision-making."

# Mark Carney generated headlines about the so-called "Carbon Bubble": Unless world leaders act, climate change could trigger financial crisis. This is a good opportunity for me to link again to my paper on the subject, which is currently Revise & Resubmit at The Economic Journal: The Carbon Bubble: Climate Policy in a Fire-Sale Model of Deleveraging

# The BBC reports on encouraging news from about the potential for a climate deal to include relatively undamaged countries accepting responsibility for those suffering a lot of damage. The article does quote Julie-Anne Richards from the campaign group, Climate Justice, saying that "the current situation being experienced with migrants in the Mediterranean was stiffening the resolve of poorer countries to make sure that an agreement on people displaced by climate change was part of any new deal. Right now if you are a low lying country you'd be looking at the Mediterranean and not having a lot of confidence that your future was guaranteed unless you could get something locked into the Paris agreement that acknowledged that vulnerable countries are going to face the worst impacts". This is an issue that those objecting to taking large numbers of Syrian refugees on the grounds that the solution should actually be to deal with ISIS, are not considering. The proximate cause of the Syria crisis was ISIS, but between 2007 and 2010, Syria had its worst drought in the instrumental record. The social upheaval that allowed ISIS to take control (while obviously helped by 2003 Iraq War) may be related to climate change, consistent with the theory of Yaneer Bar-Yam of the New England Complex Systems Institute who finds links between food prices and revolutions.

# Simon Wren-Lewis links to research showing that Voters respond to the the ‘reported’ rather than the ‘real’ economy with obvious implications to be drawn about the media in terms of their reporting of the 2015 General Election. (I can't help feeling that many of the same points could also be charged at the reporting of the 2014 Independence Referendum though too.) "Voters ... respond to how the economy ... is reported to be. ... the media really matters. ... The discussion of issues involving the economy ... among most of the ‘political class’ is often so removed from reality that it deserves the label myth. ... I do not believe I was exaggerating in suggesting that the ... myth was in good part responsible for the Conservatives winning the election. The media is vital in allowing myths to be sustained or dispelled. That does not mean that the media itself creates myths out of thin air. These myths on the economy were created by the Conservative party and their supporters, and sustained by the media’s reliance on City economists. ... Myths ... do come from real concerns... But who can deny that much of the media ... have stoked that"

# Again on refugees & migration, some cool maps from BigThink and The Independent

# Cereals, appropriability, and hierarchy discusses the neolithic roots of current cross-country differences in economic productivity. In contrast to Jared Diamond (geography determined where high farming productivity and the availability of food surpluses were), it is argued that it is not food surpluses, but rather the appropriability of crops that determines development through the incentives this creates for the emergence of complex social institutions: "increasing returns to scale in the provision of protection from theft, early farmers had to aggregate and to cooperate to defend their stored grains. Food storage and the demand for protection thus led to population agglomeration in villages and to the creation of a non-food producing elite that oversaw the provision of protection. Once a group became larger than a few dozen immediate kin, it is unlikely that those who sought protection services were as forthcoming in financing the security they desired. This public-good nature of protection was resolved by the ability of those in charge of protecting the stored food to appropriate the necessary means."

# This month's CityTalks podcast from the CentreForCities had a great contribution from FT Leader Writer Giles Wilkes on how power breeds success: "We're talking here about incentives ... What mobile businesses want ... is that they're dealing with the local leadership, that is really going to have their interests in mind ... [in the UK outside London, local leaders have little incentive to deal positively with business] and the trouble is that all of this is self-fulfilling: if you want to be, if you're a thrusting, active kind of bureaucrat or politician who wants to get ahead and improve things, you go to Westminster nowadays - that's where the power is, that's where the glory is"

# George Kerevan's article in the National also describes how London's dominance makes it impossible for other locations to get started (on the agglomeration process) in the context of the Green Investment Bank: "a Green Bank ... located in Edinburgh, which has a strong banking infrastructure and is located close to where many big renewables projects were likely to be built. ... Certainly the GIB has its formal HQ in Morrison Street in Edinburgh, next to the Conference Centre. But on enquiring you will discover that the GIB has only 50 of its current 113 staff based in the Scottish capital, handling administrative and backroom functions. The dealmakers are all based in… er, Millbank Tower in London. GIB’s chief executive is Shaun Kingsbury, ... He is based in London, lives in the Home Counties, and commutes to Scotland a couple of days a week. ... Kingsbury argues that putting together funding deals would require his people travelling to the City of London, so it makes sense to have them live there rather than commute from Edinburgh. It is an excuse I’ve heard all my life to justify London’s clammy grip on decision-making."

# Mark Carney generated headlines about the so-called "Carbon Bubble": Unless world leaders act, climate change could trigger financial crisis. This is a good opportunity for me to link again to my paper on the subject, which is currently Revise & Resubmit at The Economic Journal: The Carbon Bubble: Climate Policy in a Fire-Sale Model of Deleveraging

Sunday 30 August 2015

End August Links

# "Economically speaking, Britain is losing three or four cities a year. Blame longer commutes" shows a map of the ONS's Travel To Work Areas

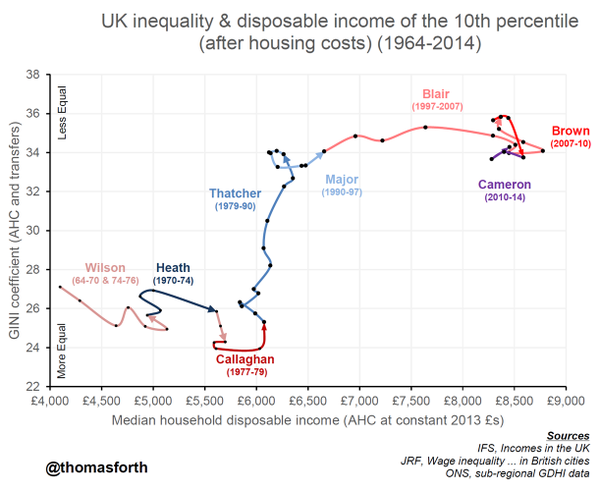

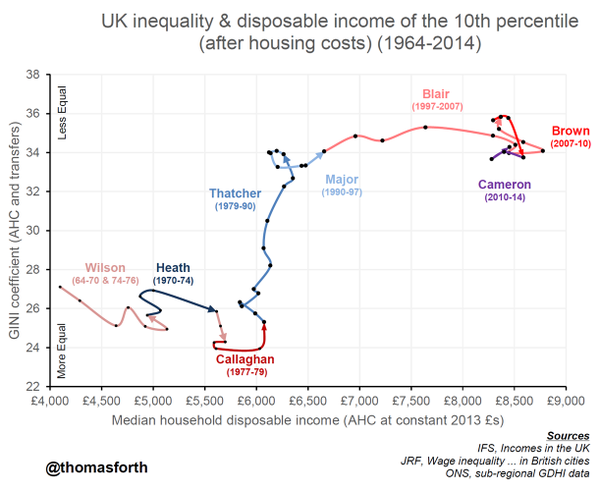

# The Up and down, left and right post on Crooked Timber has a fascinating chart showing the relative influence of Thatcher compared to almost every other UK Prime Minister in recent history:

NB x-axis is mislabelled: should say 10th percentile disposable income rather than median.

# Chris Dillow speculates on London's productivity advantage over the the rest of the UK: "The fact is that London is far more productive than the rest of the country - 29.2 per cent more so ... How can this be? The obvious possibility is that ... cities do indeed benefit from agglomeration effects: people learn from living and working alongside each other. ... But there's a problem here. If this were the case, we'd expect that cities generally would have higher productivity than less densely populated areas. But in the UK, this is not so. ... our other major cities such as Birmingham and Manchester have below-average productivity. This is consistent with another theory - that London's wealth is due not to benevolent agglomeration effects but to parasitism. It might be that big legal and financial industries actually depress economic activity elsewhere, in part by sucking talent away from other uses. ... wealthy traders want to sit on top of each other - but this could be because doing allows them to benefit from insider dealing, front-running and rigging markets rather than because of genuine productivity improvements."

# The FT has a related article which anecdotally shows the impact of a region's status - talented people go high-status and help to build the status of the place that the go, but many of the other benefits that talented people bring to an area are zero-sum - if talented person A goes to region X, then benefits accrue to that region that therefore don't accrue to the other regions. Executives erode the north-south divide "the ... company has made several announcements supporting tech start-ups, and cultural and charitable initiatives near its home in north-east England. ... the global group, one of only six English FTSE 100 companies with headquarters north of Birmingham, remains rooted in Newcastle ... and is reinvesting there. The location of company headquarters matters greatly for regional economies but in the UK there is a north-south imbalance. The majority are in London and the south east. As well as conferring kudos, company headquarters support high-level, well-paid jobs internally and in a plethora of professional firms. They can underpin schools, charities, cultural and sporting venues and help maintain a balanced demographic. They can also play a vital role in fostering start-ups and promoting economic activity. These “agglomeration” effects then make it easier to attract skilled people to an area. ... Roger Whiteside ... has noticed a behavioural change among top managers. Instead of relocating their families when they clinch a top job, nowadays, he says, executives “don’t move the family, they move themselves”. Mr Whiteside lives in London but spends three days a week in Newcastle. He says Heathrow’s Terminal 5 is packed with senior executives at 6am on Mondays. ... “I think we are very close to London,” he says. But he adds; “I don’t think people in London think we are close to them.” Getting investors to visit Vertu’s Gateshead base is like pulling teeth, he says."

# Written before the Greek Referendum on 5th July, this piece from Interfluidity is great:

"Among creditors, a big catchphrase now is “moral hazard”. We cannot be too kind to Greece, we cannot forgive their debt with few string attached, because what kind of precedent would that set? If bad borrowers, other sovereigns, got the idea that they can overborrow without consequence, if Spanish and Portuguese populists perceive perhaps a better deal is on offer, they might demand that. They might continue to borrow and expect forgiveness, and where would it end except for the bankruptcy of the good Europeans who actually produce and save? ... the term moral hazard traditionally applies to creditors. It describes the hazard to the real economy that might result if investors fail to discriminate between valuable and not-so-valuable projects when they allocate society’s scarce resources as proxied by money claims. Lending to a corrupt, clientelist Greek state that squanders resources on activities unlikely to yield growth from which the debt could be serviced? That is precisely, exactly, what the term “moral hazard” exists to discourage. You did that. Yes, the Greek state was an unworthy and sometimes unscrupulous debtor. Newsflash: The world is full of unworthy and unscrupulous entities willing to take your money and call the transaction a “loan”. It always will be. That is why responsibility for, and the consequences of, extending credit badly must fall upon creditors, not debtors."

; and

"But don’t the Greeks want to borrow more? Isn’t that what all the fuss is about right now? No. The Greeks need to borrow money now only because old loans are coming due that they have to pay, and they have been trying to come to an agreement about that, rather than raise a middle finger and walk away. The Greek state itself is not trying to expand its borrowing."

# Chris Dillow's Something for nothing culture makes some similar points to my economic efficiency arguments for property tax reform. He makes the empirical point that I had not included that: "across countries, high home ownership is associated with poor macroeconomic performance; Greeks and Italians are far more likely to own houses than Swiss or Germans"

# The market economy’s stability by Beaudry, Galizia, & Portier is interesting. It "suggests that the market economy is inherently unstable and booms and busts arise endogenously as the results of market incentives. ... In the current dominant paradigm [Stable-with-shocks], there is a tendency to see monetary policy as the central tool for mitigating the business cycle. This view makes sense if excessive macroeconomic fluctuations reflect mainly the slow adjustment of wages and prices to outside disturbances within an otherwise stable system. However, if the system is inherently unstable and exhibits forces that favour recurrent booms and busts of about seven to ten years intervals, then it is much less likely that monetary policy is the right tool for addressing macroeconomic fluctuations. Instead, in such a case we are likely to need policies aimed at changing the incentives that lead households to bunch their purchasing behaviour in the first place." Although the article does not then go on to say it, one of the major mechanisms through which households' purchasing behaviour becomes bunched is through the correlating influence of the housing (and land) markets.

# The Up and down, left and right post on Crooked Timber has a fascinating chart showing the relative influence of Thatcher compared to almost every other UK Prime Minister in recent history:

NB x-axis is mislabelled: should say 10th percentile disposable income rather than median.

# Chris Dillow speculates on London's productivity advantage over the the rest of the UK: "The fact is that London is far more productive than the rest of the country - 29.2 per cent more so ... How can this be? The obvious possibility is that ... cities do indeed benefit from agglomeration effects: people learn from living and working alongside each other. ... But there's a problem here. If this were the case, we'd expect that cities generally would have higher productivity than less densely populated areas. But in the UK, this is not so. ... our other major cities such as Birmingham and Manchester have below-average productivity. This is consistent with another theory - that London's wealth is due not to benevolent agglomeration effects but to parasitism. It might be that big legal and financial industries actually depress economic activity elsewhere, in part by sucking talent away from other uses. ... wealthy traders want to sit on top of each other - but this could be because doing allows them to benefit from insider dealing, front-running and rigging markets rather than because of genuine productivity improvements."

# The FT has a related article which anecdotally shows the impact of a region's status - talented people go high-status and help to build the status of the place that the go, but many of the other benefits that talented people bring to an area are zero-sum - if talented person A goes to region X, then benefits accrue to that region that therefore don't accrue to the other regions. Executives erode the north-south divide "the ... company has made several announcements supporting tech start-ups, and cultural and charitable initiatives near its home in north-east England. ... the global group, one of only six English FTSE 100 companies with headquarters north of Birmingham, remains rooted in Newcastle ... and is reinvesting there. The location of company headquarters matters greatly for regional economies but in the UK there is a north-south imbalance. The majority are in London and the south east. As well as conferring kudos, company headquarters support high-level, well-paid jobs internally and in a plethora of professional firms. They can underpin schools, charities, cultural and sporting venues and help maintain a balanced demographic. They can also play a vital role in fostering start-ups and promoting economic activity. These “agglomeration” effects then make it easier to attract skilled people to an area. ... Roger Whiteside ... has noticed a behavioural change among top managers. Instead of relocating their families when they clinch a top job, nowadays, he says, executives “don’t move the family, they move themselves”. Mr Whiteside lives in London but spends three days a week in Newcastle. He says Heathrow’s Terminal 5 is packed with senior executives at 6am on Mondays. ... “I think we are very close to London,” he says. But he adds; “I don’t think people in London think we are close to them.” Getting investors to visit Vertu’s Gateshead base is like pulling teeth, he says."

"Among creditors, a big catchphrase now is “moral hazard”. We cannot be too kind to Greece, we cannot forgive their debt with few string attached, because what kind of precedent would that set? If bad borrowers, other sovereigns, got the idea that they can overborrow without consequence, if Spanish and Portuguese populists perceive perhaps a better deal is on offer, they might demand that. They might continue to borrow and expect forgiveness, and where would it end except for the bankruptcy of the good Europeans who actually produce and save? ... the term moral hazard traditionally applies to creditors. It describes the hazard to the real economy that might result if investors fail to discriminate between valuable and not-so-valuable projects when they allocate society’s scarce resources as proxied by money claims. Lending to a corrupt, clientelist Greek state that squanders resources on activities unlikely to yield growth from which the debt could be serviced? That is precisely, exactly, what the term “moral hazard” exists to discourage. You did that. Yes, the Greek state was an unworthy and sometimes unscrupulous debtor. Newsflash: The world is full of unworthy and unscrupulous entities willing to take your money and call the transaction a “loan”. It always will be. That is why responsibility for, and the consequences of, extending credit badly must fall upon creditors, not debtors."

; and

"But don’t the Greeks want to borrow more? Isn’t that what all the fuss is about right now? No. The Greeks need to borrow money now only because old loans are coming due that they have to pay, and they have been trying to come to an agreement about that, rather than raise a middle finger and walk away. The Greek state itself is not trying to expand its borrowing."

# Chris Dillow's Something for nothing culture makes some similar points to my economic efficiency arguments for property tax reform. He makes the empirical point that I had not included that: "across countries, high home ownership is associated with poor macroeconomic performance; Greeks and Italians are far more likely to own houses than Swiss or Germans"

# The market economy’s stability by Beaudry, Galizia, & Portier is interesting. It "suggests that the market economy is inherently unstable and booms and busts arise endogenously as the results of market incentives. ... In the current dominant paradigm [Stable-with-shocks], there is a tendency to see monetary policy as the central tool for mitigating the business cycle. This view makes sense if excessive macroeconomic fluctuations reflect mainly the slow adjustment of wages and prices to outside disturbances within an otherwise stable system. However, if the system is inherently unstable and exhibits forces that favour recurrent booms and busts of about seven to ten years intervals, then it is much less likely that monetary policy is the right tool for addressing macroeconomic fluctuations. Instead, in such a case we are likely to need policies aimed at changing the incentives that lead households to bunch their purchasing behaviour in the first place." Although the article does not then go on to say it, one of the major mechanisms through which households' purchasing behaviour becomes bunched is through the correlating influence of the housing (and land) markets.

Wednesday 19 August 2015

Benefits of Longannet Closure?

It was announced yesterday that Longannet is to close next year. `PM blamed as end of Longannet looms': ScottishPower have blamed high transmission costs, which Scottish Government Ministers have labelled "discriminatory".

I wrote about this issue prior to the General Election, and I received a response from National Grid. This response stated that "It is true that while there is an excess of generation in Scotland, compared to local demand, then generators in Scotland pay more in transmission charges than those in England and Wales. ... It is worth noting that as the generation portfolio changes, the transmission charges will automatically adjust to reflect the direction of flows on the system – e.g. if further existing generation in Scotland closed that would cause the transmission charges for generation in Scotland to reduce and ultimately reverse."

This is not a point that I've seen in any of the coverage of Longannet's closure. Hopefully someone will be able to find the answer: by how much will transmission charges in Scotland fall as a result of the closure of Longannet? By how much (perhaps in £s per MW of installed capacity) can a windfarm (in Fife maybe) expect to improve its revenues? Could the impact of this closure on transmission charges perhaps mitigate some of the wind subsidy cuts announced by the UK Government?

I wrote about this issue prior to the General Election, and I received a response from National Grid. This response stated that "It is true that while there is an excess of generation in Scotland, compared to local demand, then generators in Scotland pay more in transmission charges than those in England and Wales. ... It is worth noting that as the generation portfolio changes, the transmission charges will automatically adjust to reflect the direction of flows on the system – e.g. if further existing generation in Scotland closed that would cause the transmission charges for generation in Scotland to reduce and ultimately reverse."

This is not a point that I've seen in any of the coverage of Longannet's closure. Hopefully someone will be able to find the answer: by how much will transmission charges in Scotland fall as a result of the closure of Longannet? By how much (perhaps in £s per MW of installed capacity) can a windfarm (in Fife maybe) expect to improve its revenues? Could the impact of this closure on transmission charges perhaps mitigate some of the wind subsidy cuts announced by the UK Government?

Monday 6 July 2015

Land Tax Footnotes

The fixed supply of land

It's not 100% accurate to say that no land is withdrawn from supply with high land taxes - it would certainly disincentivise land-owners from funding resource and mineral prospecting on their land which could be considered a form of "land creation". It also disincentivises land-owners from seeking land use re-designations (from agricultural use to residential use say). And I suppose that if someone owned a shallow seabed at the coast that could be reclaimed from the sea given investment, then a land tax would make this investment less profitable. Bryan Caplan raises this issue in A Search-Theoretic Critique of Georgism.

It can be claimed that taxing land taxes positive spillovers created by other private investment (your land value depends positively upon how nice your neighbours land is and upon private amenities close by) and that this may reduce the supply of such investment: The Problem With 100% Land Value Taxes. The anecdotal example given to describe the issue is "Real estate developers who move into neighborhoods with high vacancies, low demand, and high crime are often hoping that positive spillovers from their investment will spur additional investments from others, which will in turn make their investment more valuable." Noah Smith disagrees that land taxes are an issue here: "the problem of neighborhood externalities is a thorny one, but the LVT does not make it worse (or better)".

Land as an asset class

In an OLG model, the introduction of land crowds out productive capital formation - see Deaton & Laroque (2001)

Sounds good – let’s go

Chris Dillow posts a depressing Venn Diagram in The Economic Policy Dilemma:

Finally, worth posting another link to Noah Smith's fantastic summary: This 100-year-old idea could end San Francisco’s class war

Tuesday 30 June 2015

End June Links

# Secular Stagnation As Wising Up

# Government borrowing and long-term interest rates: a natural experiment

# Bitcoin isn’t the future of money — it’s either a Ponzi scheme or a pyramid scheme

# What Assumptions Matter for Growth Theory? is the best summary of the "Mathiness" discussion in econ blogs

# Glick & Rose The currency union effect on trade: Redux: it used to be estimated and presumed that currency union had a strong effect on trade, but recent empirical work has found much weaker effects. Basically the data hint that there are positive effects, but the size of any such effect is a strong function of the econometric technique used, and so we cannot say with any confidence that there is much of an effect on trade from CU.

# 2 pieces of great news from the Netherlands:

- Dutch court’s climate ruling may force other states to cut emissions – or else

- Dutch city of Utrecht to experiment in citizen’s income

# Not such good news on the effectiveness of energy efficiency when done in reality rather than under ideal conditions: A new study looks at federal energy-efficiency efforts — and the results are grim

# Andrew ZP Smith asks, among other things, if wind energy is actually subsidised: "The chief assistance for onshore windfarm operators comes in the form of top-up payments from bill-payers, above what the operators receive from selling their electricity in the wholesale markets. ... An electricity grid tends to rank different generators in order of marginal cost, prioritising the cheapest forms of generation. ... Cheap electricity is brought online first, and the plants with the highest marginal generation cost are saved till last. ... Wind is never the most expensive fuel on the grid, because its fuel is free. The cost of wind power is almost entirely in construction; marginal generation cost is next to nothing. Therefore when the wind blows and power is generated, it knocks out the most expensive generator (and whether that’s coal or gas, depends on their relative prices, the carbon price, and the relative efficiency of the generators) and it lowers prices across the whole market. Previous research in Germany and Spain has found that these cost reductions outweigh the revenue support paid to wind. Wind is not subsidised in those two countries – indeed, quite the reverse, wind lowers total costs for consumers."

# Evidence on the costs of Brexit? Campos, Coricelli, & Moretti conduct econometric exercises on Norway (which was able to join the EU in 1994, but chose not to) and the other 1994 candidate countries (who did join) Sweden, Finland and Austria. They find that the decision not to join the EU has reduced Norway's productivity by 6%.

# It's not often Celtic and Scottish football get a mention on VoxEU! Dominance in football: An application of Sutton’s theory of endogenous sunk costs

# People often say that lefties support Keynesian demand management because they support big government. Nick Rowe makes a good point that this doesn't make sense: "My beliefs about the optimal size of government don't matter for my beliefs about fiscal policy. My belief that the size of government matters and that there is an (interior*) optimum does matter for my beliefs about fiscal policy. It's why I'm against it." i.e. belief in big government should bias you against Keynesian demand management (all else equal).

# This Diane Coyle post is a bit rambling, but the maps are cool, there are some links that I should go back to, and it ends with a point that I entirely agree with about CBA for transport projects: "standard cost-benefit analysis does not do a good job when it comes to big infrastructure projects ... because it is a tool for assessing marginal changes, not ones which might involve large non-linearities – behaviour changes or network effects. ... it isn’t about saving 20 minutes on your journey time to increase the amount of time you can spend in a meeting at the other end."

# Government borrowing and long-term interest rates: a natural experiment

# Bitcoin isn’t the future of money — it’s either a Ponzi scheme or a pyramid scheme

# What Assumptions Matter for Growth Theory? is the best summary of the "Mathiness" discussion in econ blogs

# Glick & Rose The currency union effect on trade: Redux: it used to be estimated and presumed that currency union had a strong effect on trade, but recent empirical work has found much weaker effects. Basically the data hint that there are positive effects, but the size of any such effect is a strong function of the econometric technique used, and so we cannot say with any confidence that there is much of an effect on trade from CU.

# 2 pieces of great news from the Netherlands:

- Dutch court’s climate ruling may force other states to cut emissions – or else

- Dutch city of Utrecht to experiment in citizen’s income

# Not such good news on the effectiveness of energy efficiency when done in reality rather than under ideal conditions: A new study looks at federal energy-efficiency efforts — and the results are grim

# Andrew ZP Smith asks, among other things, if wind energy is actually subsidised: "The chief assistance for onshore windfarm operators comes in the form of top-up payments from bill-payers, above what the operators receive from selling their electricity in the wholesale markets. ... An electricity grid tends to rank different generators in order of marginal cost, prioritising the cheapest forms of generation. ... Cheap electricity is brought online first, and the plants with the highest marginal generation cost are saved till last. ... Wind is never the most expensive fuel on the grid, because its fuel is free. The cost of wind power is almost entirely in construction; marginal generation cost is next to nothing. Therefore when the wind blows and power is generated, it knocks out the most expensive generator (and whether that’s coal or gas, depends on their relative prices, the carbon price, and the relative efficiency of the generators) and it lowers prices across the whole market. Previous research in Germany and Spain has found that these cost reductions outweigh the revenue support paid to wind. Wind is not subsidised in those two countries – indeed, quite the reverse, wind lowers total costs for consumers."

# Evidence on the costs of Brexit? Campos, Coricelli, & Moretti conduct econometric exercises on Norway (which was able to join the EU in 1994, but chose not to) and the other 1994 candidate countries (who did join) Sweden, Finland and Austria. They find that the decision not to join the EU has reduced Norway's productivity by 6%.

# It's not often Celtic and Scottish football get a mention on VoxEU! Dominance in football: An application of Sutton’s theory of endogenous sunk costs

# People often say that lefties support Keynesian demand management because they support big government. Nick Rowe makes a good point that this doesn't make sense: "My beliefs about the optimal size of government don't matter for my beliefs about fiscal policy. My belief that the size of government matters and that there is an (interior*) optimum does matter for my beliefs about fiscal policy. It's why I'm against it." i.e. belief in big government should bias you against Keynesian demand management (all else equal).

# This Diane Coyle post is a bit rambling, but the maps are cool, there are some links that I should go back to, and it ends with a point that I entirely agree with about CBA for transport projects: "standard cost-benefit analysis does not do a good job when it comes to big infrastructure projects ... because it is a tool for assessing marginal changes, not ones which might involve large non-linearities – behaviour changes or network effects. ... it isn’t about saving 20 minutes on your journey time to increase the amount of time you can spend in a meeting at the other end."

Friday 26 June 2015

Is fiscal austerity contractionary under floating exchange rates?

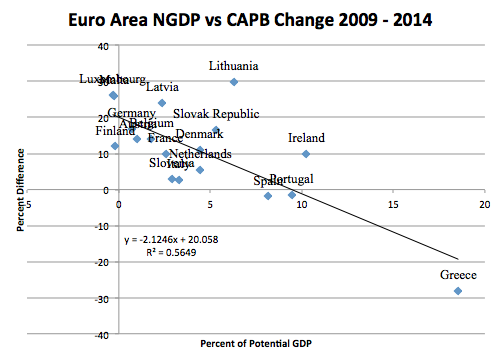

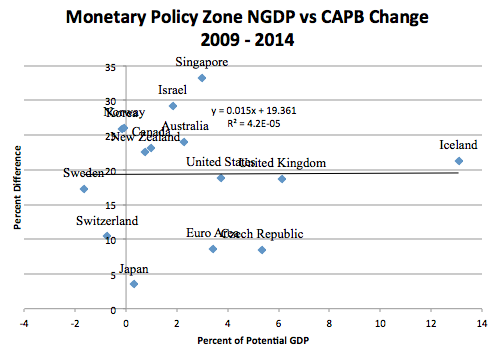

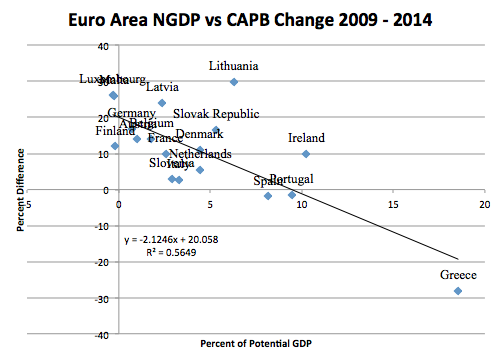

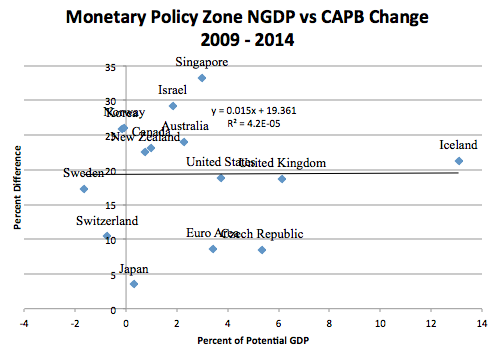

Nick Rowe points to Scott Sumner pointing to research by Mark Sadowski: basically austerity is strongly associated with weaker economic activity in the Eurozone (so country implementing it does not have control over monetary policy with which to offset the fiscal austerity), but not associated with weaker economic activity in countries with their own currency.

Graphs pinched from Scott Sumner's blog:

# Eurozone/no independent monetary policy -

# Independent monetary policy -

Scott Sumner uses this result to claim support for the "Market Monetarist" position (that monetary offset is always possible and so there is no reason to use fiscal policy), over the Keynesian position (that monetary policy is exhausted when interest rates reach their ZLB and fiscal policy should be used). The application of this result to the UK might be that the combination of austerity (to eliminate the government's budget deficit) and expansionary monetary policy (to boost the economy) is a perfectly coherent and practical policy choice.

Is this a valid conclusion to draw? As Nick Rowe says "It's 6 days now, which is a long time in the blogosphere. I have seen posts about who said what about who said what. What I want to see are posts that interpret those correlations. And other interpretations/explanations are always possible (though econometricians bravely try to minimise the number of plausible interpretations). How would you explain them?"

I would guess that an important explanation here is relative devaluation: Using data from BIS, there is a strong negative correlation between the degree of austerity and the devaluation experienced for the floating rate countries. If devaluation is associated with economic expansion (which seems plausible), but under floating exchange rates devaluation occurs at the same time as fiscal austerity, then austerity could be ceteris paribus contractionary, but we would not see the actual contraction under floating rates - so e.g. in Iceland we see austerity (contractionary) and devaluation (expansionary) and overall not much impact. In Eurozone countries we see only the ceteris paribus contractionary effect of fiscal austerity.

The problem for the policy conclusions that you might draw if this is the explanation is that in times of depression, not everyone can devalue against everyone else - it is by definition a zero sum game. So devaluation worked well for Iceland which was small and could achieve lots of relative price movement against e.g. the US, but it cannot work in general. There's still a need for fiscal policy - especially in relatively large currency zones like UK (which is certainly large relative to the Icelandic Krona).

----------------------------------------------------------

Technical results:

# Regression for eurozone/fixed rate countries. Note negative and significant coefficient for degree of austerity (capb) upon economic performance (ngdp): point estimate = -2.12, p_value = 0.1%

# Regression for floating rate countries. Insignificant relationship (p_value = 88.4%) between degree of austerity and economic performance.

# Adding trade weighted exchange rate movement over the period (xrchg) changes the picture. The correlation between the capb and xrchg variables is -63%, and the observed variation in the combination of the two variables enhances the observed negative effect of austerity upon economic activity. The austerity variable is still not significant but its 95% confidence interval includes the point estimate for the fixed rate eurozone economies.

Graphs pinched from Scott Sumner's blog:

# Eurozone/no independent monetary policy -

# Independent monetary policy -

Scott Sumner uses this result to claim support for the "Market Monetarist" position (that monetary offset is always possible and so there is no reason to use fiscal policy), over the Keynesian position (that monetary policy is exhausted when interest rates reach their ZLB and fiscal policy should be used). The application of this result to the UK might be that the combination of austerity (to eliminate the government's budget deficit) and expansionary monetary policy (to boost the economy) is a perfectly coherent and practical policy choice.

Is this a valid conclusion to draw? As Nick Rowe says "It's 6 days now, which is a long time in the blogosphere. I have seen posts about who said what about who said what. What I want to see are posts that interpret those correlations. And other interpretations/explanations are always possible (though econometricians bravely try to minimise the number of plausible interpretations). How would you explain them?"

I would guess that an important explanation here is relative devaluation: Using data from BIS, there is a strong negative correlation between the degree of austerity and the devaluation experienced for the floating rate countries. If devaluation is associated with economic expansion (which seems plausible), but under floating exchange rates devaluation occurs at the same time as fiscal austerity, then austerity could be ceteris paribus contractionary, but we would not see the actual contraction under floating rates - so e.g. in Iceland we see austerity (contractionary) and devaluation (expansionary) and overall not much impact. In Eurozone countries we see only the ceteris paribus contractionary effect of fiscal austerity.

The problem for the policy conclusions that you might draw if this is the explanation is that in times of depression, not everyone can devalue against everyone else - it is by definition a zero sum game. So devaluation worked well for Iceland which was small and could achieve lots of relative price movement against e.g. the US, but it cannot work in general. There's still a need for fiscal policy - especially in relatively large currency zones like UK (which is certainly large relative to the Icelandic Krona).

----------------------------------------------------------

Technical results:

# Regression for eurozone/fixed rate countries. Note negative and significant coefficient for degree of austerity (capb) upon economic performance (ngdp): point estimate = -2.12, p_value = 0.1%

# Regression for floating rate countries. Insignificant relationship (p_value = 88.4%) between degree of austerity and economic performance.

# Adding trade weighted exchange rate movement over the period (xrchg) changes the picture. The correlation between the capb and xrchg variables is -63%, and the observed variation in the combination of the two variables enhances the observed negative effect of austerity upon economic activity. The austerity variable is still not significant but its 95% confidence interval includes the point estimate for the fixed rate eurozone economies.

Friday 19 June 2015

I think effort is required to be this technically illiterate!

BBC Scotland reports today on a new hydro scheme: "Plans lodged with Dumfries and Galloway Council said the scheme will generate about 700 megawatts a year." Now obviously a scheme that delivered energy output at a rate that was accelerating by 700 MW per year would be fantastic: if initial output was zero, within a decade it could be generating all the electricity used in Scotland (less than 6GW) - but I knew the BBC must have got this wrong and presumably the plans were either for a big 700MW scheme, or for a small scheme that generated 700MWhrs per year. They helpfully provided a link.

In a moment of prevarication, I clicked through and saw that the plans said neither! They actually said 100kW. So the journalist must have converted 100kW to 100kWhrs per hour, then multiplied by approximately 350 days per year, and by approximately 20hrs per day to get 700MWhrs per year, and then reported it as 700MW "a" year.

This is mind blowing semi-competent incompetence!

In a moment of prevarication, I clicked through and saw that the plans said neither! They actually said 100kW. So the journalist must have converted 100kW to 100kWhrs per hour, then multiplied by approximately 350 days per year, and by approximately 20hrs per day to get 700MWhrs per year, and then reported it as 700MW "a" year.

This is mind blowing semi-competent incompetence!

Monday 1 June 2015

End May Links

# Richard Murphy highlights some interesting research which suggests that tax cuts only promote employment growth if they're directed at the lower end of the household income distribution, with no change on employment if directed towards the top of the income distribution. (Of course I'm only linking to this as confirmation bias - it's the sort of thing I'd like to be true!)

# In terms of SNP policy priorities for Westminster, I agree with Mike MacKenzie's True Grid on Bella: gaining a regulatory and subsidy regime that allows a full exploitation of Scotland's renewable energy resources should be the top priority. The news that the SNP has the chairmanship of the Energy and Climate Change select committee is therefore particularly welcome.

# Wow! No idea is this is feasible or not, but the scale of the idea from ScottishScientist is jaw-dropping: World’s biggest-ever pumped-storage hydro-scheme, for Scotland? Euan Mearns provides some criticism.

# Simon Wren-Lewis provides the best election post-mortem on the macro-economic arguments that played out in the media, and Labour's abject failure in this regard.

# In terms of SNP policy priorities for Westminster, I agree with Mike MacKenzie's True Grid on Bella: gaining a regulatory and subsidy regime that allows a full exploitation of Scotland's renewable energy resources should be the top priority. The news that the SNP has the chairmanship of the Energy and Climate Change select committee is therefore particularly welcome.

# Wow! No idea is this is feasible or not, but the scale of the idea from ScottishScientist is jaw-dropping: World’s biggest-ever pumped-storage hydro-scheme, for Scotland? Euan Mearns provides some criticism.

# Simon Wren-Lewis provides the best election post-mortem on the macro-economic arguments that played out in the media, and Labour's abject failure in this regard.

Thursday 30 April 2015

A dirty business at Longannet

A Scottish political issue, for which the responsibility lies at Westminster, is electricity network transmission charges. The present arrangements mean that suppliers pay to access the grid, and consumers face fairly uniform prices (across geographical areas) for their electricity. This made perfect sense in a world in which suppliers were indifferent about where they invested their capital (output for a given investment in a coal power station is independent of where the coal plant is). We now however live in a world in which yields on renewable infrastructure at some locations (e.g. windy Scotland) are vastly superior to the yields on the same infrastructure built at other locations. Do we now want to maintain this pricing structure? The polar opposite alternative is for suppliers to face the same grid access fees at each location, and for consumers to differentially pay for their electricity at a rate commensurate with their choice to locate either close to or far away from the fixed renewable resource. Given the current infrastructure, such a change in pricing would leave the average costs for the UK consumer unchanged, but the incentives for the purchasers of energy would be vastly different (which would of course change the infrastructure and hence the average costs after some time).

Differential consumer prices would, at the margin, provide an incentive for population movement from the congested South to the depopulated North. A larger effect is likely to be on industrial users of energy in capital intensive but low labour input facilities. Data centres, super-computers, server farms, aluminium smelters etc which do not currently get built anywhere because investment is preferentially going towards less efficient locations predicated upon patterns of existing demand, could be built specifically to consume the cheap energy produced in locations with great resources but which are far from current population centres.

Despite the relevance of this issue for Scottish voters in a Westminster election, it has not featured highly in the campaign. The SNP manifesto does say "transmission arrangements should work to support, rather than undermine, production of renewable energy in the most favourable locations", but the focus of this issue in the manifesto is to "press for a change to the transmission charging system that is penalising Scottish generators and threatening the future of Longannet power station". The closure of Longannet comes with job losses - so of course it's an emotive election issue.

But Longannet is a coal fired power station (one of Europe's biggest polluters), and by the argument above, it's appropriate for them to be cited on the basis of existing demand. So is the current pricing structure appropriate here, and hence the looming closure of the site? Stations like Longannet supply baseload power to balance out the peaks and troughs of renewable supply. It makes sense, from the point of view of minimising transmission losses, that the supply of baseload power in Scotland should equal the expected demand in Scotland less the expected renewable supply. If the closure of Longannet makes Scotland's supply of baseload electricity lower than the gap between its demand and expected renewable supply, then the current pricing structure is unreasonably discriminating against generators in Scotland. But if not, then a Scottish polity that has agreed to "ambitious commitments to carbon reduction" should be willing to let Longannet go, and focus purely upon gaining "transmission arrangements [that] work to support, rather than undermine, production of renewable energy in the most favourable locations".

Differential consumer prices would, at the margin, provide an incentive for population movement from the congested South to the depopulated North. A larger effect is likely to be on industrial users of energy in capital intensive but low labour input facilities. Data centres, super-computers, server farms, aluminium smelters etc which do not currently get built anywhere because investment is preferentially going towards less efficient locations predicated upon patterns of existing demand, could be built specifically to consume the cheap energy produced in locations with great resources but which are far from current population centres.

Despite the relevance of this issue for Scottish voters in a Westminster election, it has not featured highly in the campaign. The SNP manifesto does say "transmission arrangements should work to support, rather than undermine, production of renewable energy in the most favourable locations", but the focus of this issue in the manifesto is to "press for a change to the transmission charging system that is penalising Scottish generators and threatening the future of Longannet power station". The closure of Longannet comes with job losses - so of course it's an emotive election issue.

But Longannet is a coal fired power station (one of Europe's biggest polluters), and by the argument above, it's appropriate for them to be cited on the basis of existing demand. So is the current pricing structure appropriate here, and hence the looming closure of the site? Stations like Longannet supply baseload power to balance out the peaks and troughs of renewable supply. It makes sense, from the point of view of minimising transmission losses, that the supply of baseload power in Scotland should equal the expected demand in Scotland less the expected renewable supply. If the closure of Longannet makes Scotland's supply of baseload electricity lower than the gap between its demand and expected renewable supply, then the current pricing structure is unreasonably discriminating against generators in Scotland. But if not, then a Scottish polity that has agreed to "ambitious commitments to carbon reduction" should be willing to let Longannet go, and focus purely upon gaining "transmission arrangements [that] work to support, rather than undermine, production of renewable energy in the most favourable locations".

End April Links

# Krugman discusses Brad DeLong's additional criteria, other than public good provision, for government expenditure in The hyperbolic case for bigger government. The collective outcome of individual long term choices is not what we might choose, so it's better for public institutions to be designed democratically to offset some of the flaws we make when making intertemporal decisions if the time period these are over is "long". This sounds reasonable to me. I would add that similar reasoning applies to the spatial dimension and there is a rationale for government due to the fact that it may be that democratic allocation of land resources could be more "efficient" (in the sense of maximising ex-post satisfaction with the outcomes) than decentralised private choices. Krugman describes the desirability of public schooling provision by claiming that we might under allocate resources to schooling because we overly discount the benefits that may be received in the very long term. Another rationale for public provision is that left to individual priorities, sufficient schooling may not be provided in my area because of the choices of others. These spatial externalities are a reason why goods like schools cannot be treated like tins of beans and left to the private sector, despite the fact that they are certainly rival (a place taken at a school is a place not available to another) and excludable (you don't have the automatic ability to gain access to schooling just because a school is there if they don't let you in), and so do not fit the definition of public goods.

# Germany is imperiling the world economy by refusing to accept free money: "fixing the problem requires absolutely zero sacrifice on Germany's part. What the world needs from Berlin is for Germany to buy itself a bunch of nice shiny new transportation and energy infrastructure, or else for Germany to give itself a huge tax cut. Not only would shiny new projects and lower taxes be fun, but the message of the negative interest rates story is that by borrowing more money today Germany will improve its long-term fiscal situation." Not sure it's logically certain that it would improve Germany's long term fiscal position - but any positive return project makes economic sense if you can borrow at negative rates, and it's certainly possible that long term fiscal position is improved relative to the case with continued depressed demand and negative rates, where tax revenues likely to be lower than they otherwise would be because of general depressed environment.

# John Cochrane & JW Mason are exactly right when they say that while Greece needs to default, this is (or should be) entirely unrelated to whether is stays, or should stay, in the Euro.

# Roger Farmer says There is No Evidence that the Economy is Self-Correcting, showing that the unemployment rate seems to exhibit a unit root. As Krugman and Cochrane both say, this is ridiculous (it would have to go above 100% or below 0% eventually if that was actually the case). But I think Cochrane pretty much makes the point that Farmer trying to approximate with his model: "unemployment like other stationary ratios in macro (consumption/GDP, hours/day, etc.) have important and frequently overlooked low-frequency movements".

# I'm in the Herald: Why the consequences of inequality really are severe

# Interfluidity's Tangles of pathology proposes that Liberalism, Inequality, and the "Nonpathology" of the lowest section of society into an despised underclass, form a trilemma: a society can exhibit 2 of these but not all 3. So the Nordic economies avoid pathology, but cannot offer a large spread in economic rewards; the US does offer such unequal rewards, but its losers are treated as an underclass.

# The Swiss Have Eliminated The Zero Lower Bound!