# The New Scientist says To save the rainforest, let the locals take control - I think there's a general principle involved with this local control issue

# The Silk Road might have started as a libertarian experiment, but it was doomed to end as a fiefdom run by pirate kings

# My gut feel is that The Negative Way to Growth? by Nouriel Roubin [lowering rates should boost demand and hence inflation if run into supply constraints] is "more correct" than Doctrines Overturned by John Cochrane [given long run stability, low rates must be associated with low inflation, so perhaps central banks should be raising rates to get inflation away from zero]. Not saying Cochrane's made any sort of mistake in analysing the model, but I suspect the model is not a good map to the real world.

# Krugman learns something about reality from introspection in How negative can rates go?: we don't have to take the convenience values of cash or bank deposits into account once interest rates hit zero because at this point the marginal holder of cash or bank deposits is using them as a store of value rather than for their liquidity.

# I wanted to read this, I really did: The Paradox of Oil: The Cheaper it is, the More it Costs. But in the introduction it said: "it becomes clear that oil is a commodity that defies reductive analysis and which cannot be understood unless one looks through a multi-dimensional, interdisciplinary lens", and I gave up. To understand anything we need to reduce its description to its important features ("reductive analysis") - it's the only way to do it (other than simulating the real world over and over again to see how the full complex system behaves, i.e. conduct experiments, but this is often not possible). Obviously different people (especially from different disciplines) can disagree about which are the important features to consider. But this wishy-washy "we must think holistically and multi-dimensionally" pish is just an excuse for a non-rigorous verbal model (which is equally reductionist, but just not very good) to obscure more than it reveals.

# Climate change economics too often simply calculates the "social cost of carbon" and proclaims this to be the appropriate rate for a carbon tax. The impacts on incentives for replacement zero carbon infrastructure are rarely considered. So Adam Ozimek's thoughts in Dirty Energy Taxes And Clean Energy Innovation are important. However, I think the economies of scale and learning by doing points that he makes at the end are likely important enough to mean that his main point is not crucial though.

# The myth of Europe's little ice age

# Dr Jim Cuthbert on behalf of the Reid Foundation has the same concerns as me about the lack of tax hypothecation between whole UK and rUK/England following implementation of Smith proposals on further devolution to Scotland.

Tuesday, 31 March 2015

Sunday, 1 March 2015

End February Links

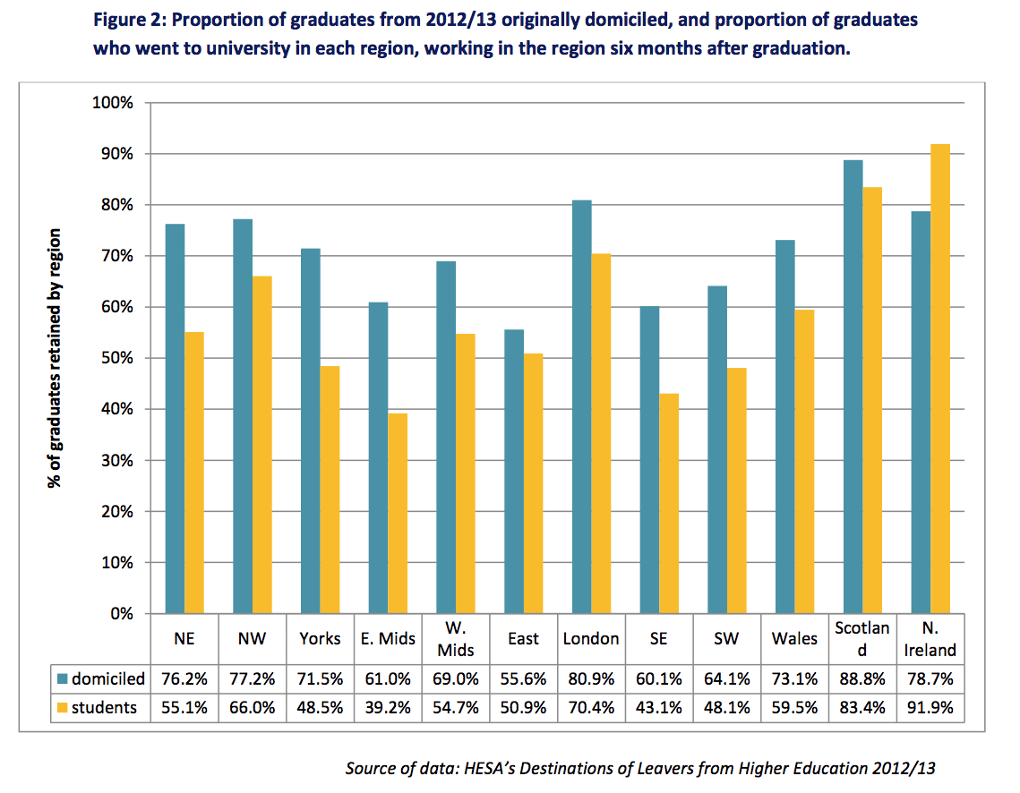

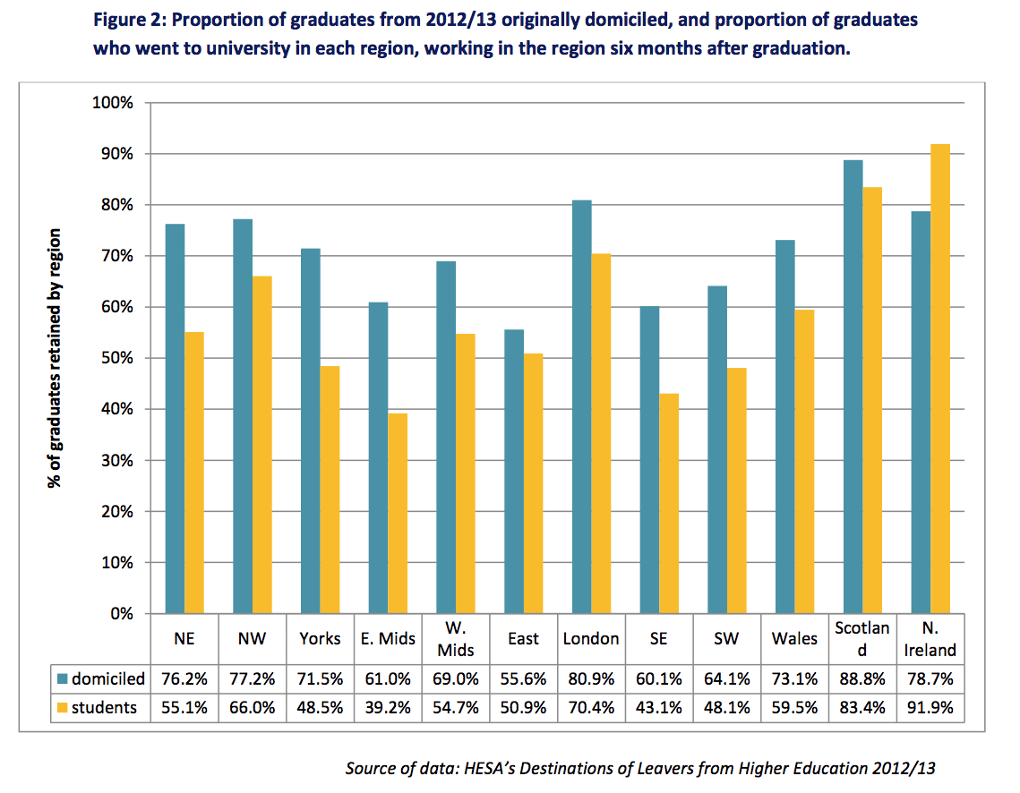

# From the Guardian, Brain drain: which UK regions hold on to their graduates?

# We live in interesting times: Something economists thought was impossible is happening in Europe (negative interest rates). And despite negative nominal interest rates being reality, George Monbiot proposes resurrecting previous monetary schemes which had structurally negative interest rates: A maverick currency scheme from the 1930s could save the Greek economy.

# Good to see English econ bloggers taking an interest in Nicola Sturgeon's anti-austerity speech.

- Chris Dillow makes a typically insightful comment in Austerity, Fear and Bubblethink, explaining her ability to take this position: "it's no accident that one of the few prominent politicians to see things as they really are works outside the Westminster bubble".

- Simon Wren-Lewis is a bit grudging claiming that since, in his view, independence would have been accompanied by more fiscal tightening, a sensible policy now must be hypocrisy. This is despite the SNP being fairly consistent in calling for expansionary fiscal policy since 2009, and doing more than the UK government to shift from revenue expenditure into capital expenditure within the constraints of a fixed budget.

- Tony Yates writing in the Independent is mendacious in the extreme. He claims that an anti-austerity position from the SNP is damaging to the anti-austerity cause! In his view the SNP are so beyond the pale (an apt phrase in this context) that policy positions they espouse may automatically be deemed less credible. But they are the government of Scotland, winning a majority under PR! They are polling between 40% and 50% of the vote in Scotland. Given this, their policy positions have to be treated as fairly centrist.

# More good Stumbling and Mumbling posts:

- In Origins of bad policy Chris Dillow points out that "in German 'debt' and 'guilt' are the same words" - I can label this as German homework!

- Some economics in the Hari Seldon/Psychohistory mould in Created by History

- Individual rationality versus ecological diversity, and why British politics might be due to undergo a step change, in Heading for Extinction

# Simon Wren-Lewis's Endogenous supply and depressed demand makes a fairly convincing case that, despite the UK's employment rate being back to pre-crisis levels, we may still be in a depressed economic environment, and that the appropriate policy is to loosen until we are clearly in a regime in which wage inflation is consistent with monetary targets: "after a severe recession which appears to result in a loss of capacity, you use policy to explore the boundaries of just how much capacity has really been lost, and run the risk that inflation may rise as you do so. You do not sit back, tell yourself that below target inflation is probably temporary, and do nothing. And, of course, you do not plan for more fiscal austerity."

# We live in interesting times: Something economists thought was impossible is happening in Europe (negative interest rates). And despite negative nominal interest rates being reality, George Monbiot proposes resurrecting previous monetary schemes which had structurally negative interest rates: A maverick currency scheme from the 1930s could save the Greek economy.

# Good to see English econ bloggers taking an interest in Nicola Sturgeon's anti-austerity speech.

- Chris Dillow makes a typically insightful comment in Austerity, Fear and Bubblethink, explaining her ability to take this position: "it's no accident that one of the few prominent politicians to see things as they really are works outside the Westminster bubble".

- Simon Wren-Lewis is a bit grudging claiming that since, in his view, independence would have been accompanied by more fiscal tightening, a sensible policy now must be hypocrisy. This is despite the SNP being fairly consistent in calling for expansionary fiscal policy since 2009, and doing more than the UK government to shift from revenue expenditure into capital expenditure within the constraints of a fixed budget.

- Tony Yates writing in the Independent is mendacious in the extreme. He claims that an anti-austerity position from the SNP is damaging to the anti-austerity cause! In his view the SNP are so beyond the pale (an apt phrase in this context) that policy positions they espouse may automatically be deemed less credible. But they are the government of Scotland, winning a majority under PR! They are polling between 40% and 50% of the vote in Scotland. Given this, their policy positions have to be treated as fairly centrist.

# More good Stumbling and Mumbling posts:

- In Origins of bad policy Chris Dillow points out that "in German 'debt' and 'guilt' are the same words" - I can label this as German homework!

- Some economics in the Hari Seldon/Psychohistory mould in Created by History

- Individual rationality versus ecological diversity, and why British politics might be due to undergo a step change, in Heading for Extinction

# Simon Wren-Lewis's Endogenous supply and depressed demand makes a fairly convincing case that, despite the UK's employment rate being back to pre-crisis levels, we may still be in a depressed economic environment, and that the appropriate policy is to loosen until we are clearly in a regime in which wage inflation is consistent with monetary targets: "after a severe recession which appears to result in a loss of capacity, you use policy to explore the boundaries of just how much capacity has really been lost, and run the risk that inflation may rise as you do so. You do not sit back, tell yourself that below target inflation is probably temporary, and do nothing. And, of course, you do not plan for more fiscal austerity."

Subscribe to:

Comments (Atom)