This is blatant self-promotion...

Based on last month's post, White Paper Reflections - Budget, last week I spoke at a Scottish TUC conference. The STUC's Stephen Boyd has written a very generous description of my talk in his write up of the event, and my slides are available.

Sunday, 15 December 2013

Sunday, 1 December 2013

End November Links

# The LSE blog had a great post, Britain’s spatially unbalanced economy is both wasteful and unstable. The solution requires much more than small-scale measures: "The fact that after nearly ninety years of regional policy Britain’s economy is still spatially divided between South and North suggests that the problem is a systemic one, requiring a systemic solution. It is often claimed that the success of London and the South East is merely testament to the ‘natural workings’ of the market. Some take this argument further and suggest that we should encourage economic activity and workers to abandon northern towns and cities and move to the South to maximize growth there. Such pronouncements fail to acknowledge the reality that the economies of London and the South East are not simply driven by market forces, but also heavily underwritten by the State; that this part of the country enjoys preferential access to finance; that it is able to exert a disproportionate influence on government economic policy; and that in London it has a city which has a degree of political and economic autonomy not found in other UK cities." If systemic, the problem should be amenable to modelling. What's the mechanism? Does it imply that autonomy leads to growth?

# - Henrik Jensen: Willem and the Negative Nominal Interest Rate

- Secular Stagnation, Coalmines, Bubbles, and Larry Summers

- Why the future looks sluggish: "another possibility, ..., is to use today’s glut of savings to finance a surge in public investment. That might be partly linked to a shift to lower-carbon growth. Another possibility is to facilitate capital flows to emerging and developing countries, where the best investment opportunities must lie. It makes no sense for so much of the world’s savings to seek investment opportunities where they do not apparently exist and shy away from places where, one hopes, they do."

- Secular stagnation, bubbles & inequality

- Monetary and Fiscal Implications of Secular Stagnation [don't completely agree with:

"The point is that the case against austerity is as strong as it ever was. And maybe even stronger, once you think about debt dynamics. Right now the real interest rate on US government borrowing is about 0.5 percent on 10-year securities, negative 0.4 percent on 5-year. Meanwhile, even pessimistic estimates of US potential growth put it in the 1.5-2 percent range. So r is less than g — the real interest rate on debt is less than the normal growth rate. This in turn means that the usual worry about a rising debt level — that it will require that we eventually run big non-interest surpluses to pay down the debt — is all wrong."

Secular stagnation will lower g with r, so I'm not sure it helps public finances]

- The (non) politics of stagnation.

# The intergalactic trade frontier: "Trade moralists are fundamentally illogical and dangerously plausible. The idea of exporting your way to recovery is seductive. But it simply is not possible for all countries to export their way to recovery. Someone, somewhere has to have a trade deficit."

# Scottish Economy Watch's "Independence Facts" series:

- 1: Trade flows, migration flows and capital flows are significantly lower across international borders than within a country

- 2: Small states have higher per capita GDP (are richer) than other states

- 3: Growth in small countries is neither more or less fast than in other countries but is more volatile

- 4: Scotland's exports to rest of UK account for 70% of its exports. Rest of UK exports to Scotland account for 11% of its exports

# I love maps like this: The UK as a cartogram

# International interest in the referendum, especially on currency, and all concluding that a currency union is not such a great idea:

- Scotland, Sterling, and the debt

- A history lesson for Scotland

- Scotland must be braver "Scotland must bite the bullet and fearlessly seek to establish its own currency. ... Edinburgh ought to declare its intention to create a Scottish Central Bank and a temporary currency board that will peg the new currency to sterling before, once cross-border capital movements have been stabilised, the Scottish pound is allowed to float freely and Edinburgh’s monetary authorities set Scottish interest rates with a Scottish inflation target in mind."

# - Henrik Jensen: Willem and the Negative Nominal Interest Rate

- Secular Stagnation, Coalmines, Bubbles, and Larry Summers

- Why the future looks sluggish: "another possibility, ..., is to use today’s glut of savings to finance a surge in public investment. That might be partly linked to a shift to lower-carbon growth. Another possibility is to facilitate capital flows to emerging and developing countries, where the best investment opportunities must lie. It makes no sense for so much of the world’s savings to seek investment opportunities where they do not apparently exist and shy away from places where, one hopes, they do."

- Secular stagnation, bubbles & inequality

- Monetary and Fiscal Implications of Secular Stagnation [don't completely agree with:

"The point is that the case against austerity is as strong as it ever was. And maybe even stronger, once you think about debt dynamics. Right now the real interest rate on US government borrowing is about 0.5 percent on 10-year securities, negative 0.4 percent on 5-year. Meanwhile, even pessimistic estimates of US potential growth put it in the 1.5-2 percent range. So r is less than g — the real interest rate on debt is less than the normal growth rate. This in turn means that the usual worry about a rising debt level — that it will require that we eventually run big non-interest surpluses to pay down the debt — is all wrong."

Secular stagnation will lower g with r, so I'm not sure it helps public finances]

- The (non) politics of stagnation.

# The intergalactic trade frontier: "Trade moralists are fundamentally illogical and dangerously plausible. The idea of exporting your way to recovery is seductive. But it simply is not possible for all countries to export their way to recovery. Someone, somewhere has to have a trade deficit."

# Scottish Economy Watch's "Independence Facts" series:

- 1: Trade flows, migration flows and capital flows are significantly lower across international borders than within a country

- 2: Small states have higher per capita GDP (are richer) than other states

- 3: Growth in small countries is neither more or less fast than in other countries but is more volatile

- 4: Scotland's exports to rest of UK account for 70% of its exports. Rest of UK exports to Scotland account for 11% of its exports

# I love maps like this: The UK as a cartogram

# International interest in the referendum, especially on currency, and all concluding that a currency union is not such a great idea:

- Scotland, Sterling, and the debt

- A history lesson for Scotland

- Scotland must be braver "Scotland must bite the bullet and fearlessly seek to establish its own currency. ... Edinburgh ought to declare its intention to create a Scottish Central Bank and a temporary currency board that will peg the new currency to sterling before, once cross-border capital movements have been stabilised, the Scottish pound is allowed to float freely and Edinburgh’s monetary authorities set Scottish interest rates with a Scottish inflation target in mind."

Tuesday, 26 November 2013

The White Paper vs the IFS

Many of the questions, both actually asked in the press conference, and hypothetically asked in the Q&A in Part 5 of the White Paper, drew a comparison between the optimistic assessment of Scotland’s economy from the Scottish Government against last week’s negative assessment from the Institute for Fiscal Studies.

Firstly it is important to note what the IFS actually did: they compared projected UK finances with projected Scottish finances, both under what can be labelled as “best estimate, given current policy”. What these projections show is that, under union, Scotland would either start to see large subsidies from rUK, or it would see its budget cut. Prof Brian Ashcroft has shown that Scottish funding has actually tracked Scotland’s net fiscal position reasonably closely (Has Scotland already spent its oil fund?) – there is no reason to expect this relationship to change going forward (especially when England and Wales are agitating about the Barnett Formula). The IFS report really said nothing about the finances of Yes vs No: it described the finances of Yes under the policies of No, and said nothing about either the finances of No under the policies of No or the finances of Yes under the policies of Yes.

What the Scottish Government’s White Paper seeks to do is outline some of the policies of Yes and to speculate on the finances. In the short run, p75 of the White Paper presents a budget for a newly independent Scotland that is more optimistic than the IFS. This is explained almost entirely by a more optimistic short run assessment of oil revenues:

In the long run, to avoid the tax rises or spending cuts needed under the IFS projection, the Scottish Government has to counter the demographic decline that is ‘baked-in’ given the current age profile of the Scottish population. There are two ways to do this and the White Paper describes policies in both areas.

In the long run, to avoid the tax rises or spending cuts needed under the IFS projection, the Scottish Government has to counter the demographic decline that is ‘baked-in’ given the current age profile of the Scottish population. There are two ways to do this and the White Paper describes policies in both areas.

The first way is to increase the labour market participation rates of, and hence tax take from, the current population. The policy of enhanced childcare provision is explicitly justified in these terms: enhanced childcare would allow greater labour market participation by parents who would otherwise have childcare responsibilities. Whilst the policy would have a spending cost it would also have revenue benefits from the expanded tax base. To the extent that such a policy also reduces the cost to parents of having children, it may improve Scotland’s long term demographic outlook if people respond to this incentive.

This enhanced childcare policy can be criticised as something that can be implemented under the current devolved settlement. But the current settlement essentially provides the Scottish Government with funds to implement its equivalent of policy implemented in England (the Barnett Consequentials). If England is not implementing this policy, then the funds are not necessarily there for its implementation in Scotland. Further, to the extent that the costs are borne now and the benefits seen in the future, the balanced budget constraint embedded in the block grant is not a good funding mechanism. Finally, the costs will be borne by the Scottish budget, so if this policy is to be self-funding, the increased tax revenues must also go into the Scottish revenue. This is not true under the current settlement (and it will not hold even under the enhanced devolution of the Scotland Act 2012).

The other way, and this is a policy lever not available under the current settlement, is to implement policy to attract more immigration. The White Paper expresses the desire for a more liberal immigration policy than that pertaining to the rest of the UK. Specifically this would involve a points based immigration system, and a reintroduction of the student visas removed by Westminster.

The Scottish Government’s task in outlining how the future will be more favourable under independence is difficult: if these policies are so good then why doesn’t the UK Government implement them? But on immigration especially there is a clear dividing line: The IFS report assumed that the ONS low migration scenario was most consistent with current UK Government policy. In this White Paper, the Scottish Government are clearly expressing their desire that immigration be higher than this.

Tuesday, 5 November 2013

End October Links

# What does the long term price guarantee for electricity given by the UK Government (UK nuclear power plant gets go-ahead) say about Prof Gordon Hughes's contention (at last month's International Conference on Economics of Constitutional Change [slides and paper here]) that given current high prices, we should expect energy prices to fall, and that English consumers are unlikely to want to buy low carbon electricity from a renewables-powered Scotland?

# Of academic interest:

- The Fractal Market Hypothesis and its implications for the stability of financial markets (related to Mandelbrot's 'The Variation of Certain Speculative Prices')

# Wayhey!? Nuclear fusion milestone passed at US lab: "during an experiment in late September, the amount of energy released through the fusion reaction exceeded the amount of energy being absorbed by the fuel - the first time this had been achieved at any fusion facility in the world"

# Borrowing from the Future — Except that We Aren't: "At an individual level, borrowing is truly borrowing from the future. At a population level, borrowing is the creation of assets and liabilities across different people. People like King are committing a fallacy of composition. Incidentally, we are borrowing from the future. We are shirking the investments we need to make so that our children and grandchildren can live in a habitable world with a well-educated population that enjoys a productive infrastructure. No fallacy of composition there."

# Interfluidity say that Mobility is no answer to dispersion: "If we augment standard utility functions with plausible notions of habit formation and social reference group comparison, the case against mobility grows even stronger. The cost and shame of downward mobility dramatically outmatches the potential benefit of upward mobility...A functional polity values rising fortunes across the wealth spectrum, but it fears and resists falling fortunes much more strenuously. I would go so far as to claim this is a universal social fact, a characteristic of all polities that endure. Capitalism is always crony capitalism — and socialism tends towards crony socialism! — not because of corrupt bad actors but because human lifestyles are sticky-downward. Large social divergences can in practice be remedied smoothly only by convergence upward from the bottom. The wise course is to prevent extreme divergence from emerging in the first place. Once it has, the only way out is to hope for growth, and to direct the fruits of growth towards the bottom of the distribution."

# Great idea from Chris Dillow: Shares in people

# From the ESRC's Future of the UK and Scotland project blog: How the SNP can still win the vote for an independent Scotland "Poor rates of economic growth, high levels of emigration and appalling social and health conditions of Scotland should be difficult to defend. If independence is to be judged over the long haul, so too should the union. Yet supporters of the union have been under little pressure to defend Scotland's miserable record within it. Historians will look back on this campaign and ask why unionists were not on the defensive given this poor track record."

# George Rosie Losing the Heid - this has to describe the losses that come from being a peripheral region of a large country (as well as a peculiarly British attitude to corporate ownership). Such losses might well be simply reallocative (and may even represent aggregate efficiency gains) but they are certainly losses to those of us who live in Scotland (and north England, Northern Ireland, and Wales). I suspect once imperfect information and agency problems are included in the analysis that they likely also do not represent aggregate efficiency gains.

# Of academic interest:

- The Fractal Market Hypothesis and its implications for the stability of financial markets (related to Mandelbrot's 'The Variation of Certain Speculative Prices')

# Wayhey!? Nuclear fusion milestone passed at US lab: "during an experiment in late September, the amount of energy released through the fusion reaction exceeded the amount of energy being absorbed by the fuel - the first time this had been achieved at any fusion facility in the world"

# Borrowing from the Future — Except that We Aren't: "At an individual level, borrowing is truly borrowing from the future. At a population level, borrowing is the creation of assets and liabilities across different people. People like King are committing a fallacy of composition. Incidentally, we are borrowing from the future. We are shirking the investments we need to make so that our children and grandchildren can live in a habitable world with a well-educated population that enjoys a productive infrastructure. No fallacy of composition there."

# Interfluidity say that Mobility is no answer to dispersion: "If we augment standard utility functions with plausible notions of habit formation and social reference group comparison, the case against mobility grows even stronger. The cost and shame of downward mobility dramatically outmatches the potential benefit of upward mobility...A functional polity values rising fortunes across the wealth spectrum, but it fears and resists falling fortunes much more strenuously. I would go so far as to claim this is a universal social fact, a characteristic of all polities that endure. Capitalism is always crony capitalism — and socialism tends towards crony socialism! — not because of corrupt bad actors but because human lifestyles are sticky-downward. Large social divergences can in practice be remedied smoothly only by convergence upward from the bottom. The wise course is to prevent extreme divergence from emerging in the first place. Once it has, the only way out is to hope for growth, and to direct the fruits of growth towards the bottom of the distribution."

# Great idea from Chris Dillow: Shares in people

# From the ESRC's Future of the UK and Scotland project blog: How the SNP can still win the vote for an independent Scotland "Poor rates of economic growth, high levels of emigration and appalling social and health conditions of Scotland should be difficult to defend. If independence is to be judged over the long haul, so too should the union. Yet supporters of the union have been under little pressure to defend Scotland's miserable record within it. Historians will look back on this campaign and ask why unionists were not on the defensive given this poor track record."

# George Rosie Losing the Heid - this has to describe the losses that come from being a peripheral region of a large country (as well as a peculiarly British attitude to corporate ownership). Such losses might well be simply reallocative (and may even represent aggregate efficiency gains) but they are certainly losses to those of us who live in Scotland (and north England, Northern Ireland, and Wales). I suspect once imperfect information and agency problems are included in the analysis that they likely also do not represent aggregate efficiency gains.

Monday, 7 October 2013

End September Links

# Interesting academic research:

- Recasting international income differences: The next-generation Penn World Table, Robert C Feenstra, Robert Inklaar, Marcel Timmer

- Immigration, diversity, and economic prosperity, Alberto Alesina, Johann Harnoss, Hillel Rapoport

- Creativity, cities and innovation, Neil Lee, Andrés Rodríguez-Pose

- The economic future of British cities, Henry Overman

# Savings, investments, and a dose of realism - Frances Coppola is nicer than me about greetin' faced savers organisations...

# Typically interesting posts from Chris Dillow, On wage-led growth; & Interfluidity, Not a monetary phenomenon & Terminal demographics

# Chris Dillow gives a pointer towards some literature on diseconomies of scale: The Management Question

# How relevant is this for any proposed Sterling Union? Why asymmetrical monetary unions are bound to fail

# A useful resource: Migration in Scotland

# Interesting column in the Guardian: UK Growth? Make London independent to mend the North-South divide. I'm not sure about conclusion though: "Were the government to publish regional trade figures, they would show that London runs a current account surplus with the rest of the UK, offset by capital transfers from the rich south to the poorer north. As an independent city state, London would have a higher exchange rate and higher borrowing costs. The rest of the country would, by contrast, get a competitive boost." A London GOVERNMENT would be in surplus vis-a-vis the rest of the UK, but that's not the same as London running a current account surplus (selling to more than it buys from) and paying capital transfers north. I suspect that the private savings made by the rest of the UK, on net, go TO London. And it definitely does not seem obvious to me that total capital flows (private savings plus fiscal transfers) are from London to the rest of the UK. Of course I might be wrong...

# From same column, I'm also interested in the point about "the strength of persistence over time in patterns of relative unemployment at local level" (which comes from a Paul Ormerod article in Applied Economics Letters): are markets not flexible enough, or is policy not good enough? If it's the second point then the North-South divide would argue for the existence of policy that was good for the South but not so good for the North. And the relevance of this to the Scottish independence debate is...

- Recasting international income differences: The next-generation Penn World Table, Robert C Feenstra, Robert Inklaar, Marcel Timmer

- Immigration, diversity, and economic prosperity, Alberto Alesina, Johann Harnoss, Hillel Rapoport

- Creativity, cities and innovation, Neil Lee, Andrés Rodríguez-Pose

- The economic future of British cities, Henry Overman

# Savings, investments, and a dose of realism - Frances Coppola is nicer than me about greetin' faced savers organisations...

# Typically interesting posts from Chris Dillow, On wage-led growth; & Interfluidity, Not a monetary phenomenon & Terminal demographics

# Chris Dillow gives a pointer towards some literature on diseconomies of scale: The Management Question

# How relevant is this for any proposed Sterling Union? Why asymmetrical monetary unions are bound to fail

# A useful resource: Migration in Scotland

# Interesting column in the Guardian: UK Growth? Make London independent to mend the North-South divide. I'm not sure about conclusion though: "Were the government to publish regional trade figures, they would show that London runs a current account surplus with the rest of the UK, offset by capital transfers from the rich south to the poorer north. As an independent city state, London would have a higher exchange rate and higher borrowing costs. The rest of the country would, by contrast, get a competitive boost." A London GOVERNMENT would be in surplus vis-a-vis the rest of the UK, but that's not the same as London running a current account surplus (selling to more than it buys from) and paying capital transfers north. I suspect that the private savings made by the rest of the UK, on net, go TO London. And it definitely does not seem obvious to me that total capital flows (private savings plus fiscal transfers) are from London to the rest of the UK. Of course I might be wrong...

# From same column, I'm also interested in the point about "the strength of persistence over time in patterns of relative unemployment at local level" (which comes from a Paul Ormerod article in Applied Economics Letters): are markets not flexible enough, or is policy not good enough? If it's the second point then the North-South divide would argue for the existence of policy that was good for the South but not so good for the North. And the relevance of this to the Scottish independence debate is...

Wednesday, 25 September 2013

A fair division of reputational assets

In the Scottish independence debate, HM Treasury has asserted, in the first of its Scotland Analysis series of papers, that Scotland would become an entirely new state, with rUK inheriting the legal personality of the current UK. Needless to say, the Scottish Government did not agree with this statement and Nicola Sturgeon pointed out its status: it is legal opinion, this is perhaps very well informed opinion, but opinion nonetheless. This was much discussed at the time in terms of its implications on EU membership etc, but a new implication of this assumption is emerging.

At the International Conference on Economics of Constitutional Change held last week in Edinburgh, Dr Angus Armstrong of the National Institute of Economic and Social Research (NIESR) presented a paper on the currency options for an independent Scotland (Armstrong & Ebell), making the link that debt levels were an important consideration in making this currency choice. The analysis underlying this paper appears sound: it concludes that a small state with volatile tax revenues will pay a higher interest rate on its borrowings than a larger state with stable tax revenues (for a given average tax revenue per unit GDP, and debt stock level per unit GDP). The methodology looks solid and the conclusions are intuitive.

I do however question the assumption made in this paper about the splitting of debt. It suggests that rUK is "the continuing UK" and that newly independent "Scotland would also have to compensate the continuing UK for being relieved of its fair share of the existing UK public debt at the time of independence". Whilst both the UK and Scottish Governments have agreed that the assets and liabilities of the current UK should be split fairly, they may disagree on the method of this splitting, and what constitutes 'fair'. However there seems to be an emerging consensus that assets fixed in geography should accrue to the country in which they reside, and moveable or financial assets and liabilities should be split on a population basis. So let's consider splitting the UK debt by population and look at the consequences of assuming that "Scotland would also have to compensate the continuing UK for being relieved of its fair share of the existing UK public debt at the time of independence".

To simplify things massively let's assume that:

# the market value of UK debt, at the point at which it is to be split, is £1359B

# this is all 5 year zero coupon bonds

# which yield 2%p.a.

# Scotland is 10% of the UK by population

# The analysis in Armstrong & Ebell suggests that Scotland would pay 3.5% on its debt [this is not the real number from the paper, but just to keep things relatively simple].

The face value of the outstanding debt stock is £1500B. I think a reasonable way to split this is that Scotland becomes responsible for repaying 10% of this face value, £150B, as it becomes due. rUK would pay the other £1350B on the due date. The current market value of the debt will fall as existing creditors are not as happy with their new counter-parties as they were under the previous union. But this happens after every election: a prudent government issues debt for sensible reasons at low interest rates; then loses an election to an imprudent government and the interest rate rises; existing debt-holders get burnt. The Scottish independence referendum is another election, and not one that creditors can reasonably claim to have been ignorant about: most of the existing debt stock has been issued since 2007 when the SNP first came to power.

However, if the rUK was to be considered as "the continuing UK" then the scenario I've outlined in the previous paragraph may constitute a default by the UK - something that "the continuing UK" will never do. And if instead Scotland has to buy out the debt from rUK by raising new Scottish debt, it would need to pay rUK £136B to extinguish its liability, by issuing 5 year zero coupon bonds with face value of £161B - rather than £150B. This boils down to saying that in order for rUK to maintain the reputation of the current UK in international credit markets, Scotland should pay a premium. Is this 'fair'? In my view, any reputational assets currently "owned" by the UK should also be divided fairly.

At the International Conference on Economics of Constitutional Change held last week in Edinburgh, Dr Angus Armstrong of the National Institute of Economic and Social Research (NIESR) presented a paper on the currency options for an independent Scotland (Armstrong & Ebell), making the link that debt levels were an important consideration in making this currency choice. The analysis underlying this paper appears sound: it concludes that a small state with volatile tax revenues will pay a higher interest rate on its borrowings than a larger state with stable tax revenues (for a given average tax revenue per unit GDP, and debt stock level per unit GDP). The methodology looks solid and the conclusions are intuitive.

I do however question the assumption made in this paper about the splitting of debt. It suggests that rUK is "the continuing UK" and that newly independent "Scotland would also have to compensate the continuing UK for being relieved of its fair share of the existing UK public debt at the time of independence". Whilst both the UK and Scottish Governments have agreed that the assets and liabilities of the current UK should be split fairly, they may disagree on the method of this splitting, and what constitutes 'fair'. However there seems to be an emerging consensus that assets fixed in geography should accrue to the country in which they reside, and moveable or financial assets and liabilities should be split on a population basis. So let's consider splitting the UK debt by population and look at the consequences of assuming that "Scotland would also have to compensate the continuing UK for being relieved of its fair share of the existing UK public debt at the time of independence".

To simplify things massively let's assume that:

# the market value of UK debt, at the point at which it is to be split, is £1359B

# this is all 5 year zero coupon bonds

# which yield 2%p.a.

# Scotland is 10% of the UK by population

# The analysis in Armstrong & Ebell suggests that Scotland would pay 3.5% on its debt [this is not the real number from the paper, but just to keep things relatively simple].

The face value of the outstanding debt stock is £1500B. I think a reasonable way to split this is that Scotland becomes responsible for repaying 10% of this face value, £150B, as it becomes due. rUK would pay the other £1350B on the due date. The current market value of the debt will fall as existing creditors are not as happy with their new counter-parties as they were under the previous union. But this happens after every election: a prudent government issues debt for sensible reasons at low interest rates; then loses an election to an imprudent government and the interest rate rises; existing debt-holders get burnt. The Scottish independence referendum is another election, and not one that creditors can reasonably claim to have been ignorant about: most of the existing debt stock has been issued since 2007 when the SNP first came to power.

However, if the rUK was to be considered as "the continuing UK" then the scenario I've outlined in the previous paragraph may constitute a default by the UK - something that "the continuing UK" will never do. And if instead Scotland has to buy out the debt from rUK by raising new Scottish debt, it would need to pay rUK £136B to extinguish its liability, by issuing 5 year zero coupon bonds with face value of £161B - rather than £150B. This boils down to saying that in order for rUK to maintain the reputation of the current UK in international credit markets, Scotland should pay a premium. Is this 'fair'? In my view, any reputational assets currently "owned" by the UK should also be divided fairly.

Monday, 9 September 2013

Sans Frontières

Number 5 in the 'Scotland Analysis' series from the UK Government was published last week: "it discusses the macroeconomic performance of Scotland as part of the UK ... and the potential impact of a border between Scotland and the rest of the UK". Despite much ridicule from Yes supporting quarters, I think the HM Treasury estimate of the size of the potential "border effect" between Scotland and the rest of the UK is on the conservative side. The argument that, because economic forecasts are generally rubbish, it is impossible to make the case that a particular intervention is likely to be economically costly or beneficial, is a fatuous one.

I have written about the border effect before: it is the real phenomenon under which trade within a nation state is much higher than trade across a national boundary, even a national boundary within the EU. Why? Who knows, but we observe that this is the case. If trade is valuable then the reduction in trade associated with the creation of a border will be costly.

Though it is a real effect, its importance should not be overstated: HMT report a long run (actually steady state) value of 4% of Scotland's GDP, and a not unreasonable parameterisation could produce anything up to maybe 10% of Scotland's GDP. HMT further suppose that this long run steady state might be reached in 30 years. If this is a reasonable timeframe, then we are discussing a mechanism which may have an impact on GDP growth of between 0.1% and 0.3% per year. Given expected GDP growth of between 2% and 3%, an effect of this magnitude will be almost undetectable on a yearly basis, but cumulative over time.

So the border effect will likely have only a small effect on annual GDP growth rates, but on whose GDP growth rates will it impact? The mechanism by which borders have an economic cost is that it prevents productive firms expanding and shelters unproductive firms from competition. If firms were geographically fixed then the cost of the border would fall predominantly on Scotland as the smaller party. However, the following scenario outlines a case consistent with a costly border effect, but under which the cost falls on rUK:

As the Treasury say, the border effect also applies to migration flows as well as trade flows. I have also written about migration and population: migration over the Scottish-English border is currently roughly balanced, but that this is an atypical situation by comparison with the 20th century. Even with balanced migration it is possible that Scotland loses out and could benefit from a reduction in these gross flows: this would be the case if these flows represented a net export of human capital from Scotland. Perhaps we export the brightest and best of our young people to the head offices of London, and import middle managers to run branch offices and pensioners to enjoy the views? Demographics also demand that Scotland cannot do with only balanced flows anyway: it needs “net imports” of young people. This may be increasingly unlikely within the UK if the political centre is dragged UKIP’s way.

To summarise, the critique of the border effect is fatuous and confuses a discussion of mechanisms with economic forecasts. The border effect is real and, all other things equal, it is a cost of independence which should not be rubbished. However, all other things are never equal, and if low barriers to trade mean that Scotland is exporting its productive capacity south, then the possibility exists that the border effect could be part of the reasons for independence.

And remember, HMT are currently working for political masters who want an In/Out referendum of the EU. The border effect applies there too.

I have written about the border effect before: it is the real phenomenon under which trade within a nation state is much higher than trade across a national boundary, even a national boundary within the EU. Why? Who knows, but we observe that this is the case. If trade is valuable then the reduction in trade associated with the creation of a border will be costly.

Though it is a real effect, its importance should not be overstated: HMT report a long run (actually steady state) value of 4% of Scotland's GDP, and a not unreasonable parameterisation could produce anything up to maybe 10% of Scotland's GDP. HMT further suppose that this long run steady state might be reached in 30 years. If this is a reasonable timeframe, then we are discussing a mechanism which may have an impact on GDP growth of between 0.1% and 0.3% per year. Given expected GDP growth of between 2% and 3%, an effect of this magnitude will be almost undetectable on a yearly basis, but cumulative over time.

So the border effect will likely have only a small effect on annual GDP growth rates, but on whose GDP growth rates will it impact? The mechanism by which borders have an economic cost is that it prevents productive firms expanding and shelters unproductive firms from competition. If firms were geographically fixed then the cost of the border would fall predominantly on Scotland as the smaller party. However, the following scenario outlines a case consistent with a costly border effect, but under which the cost falls on rUK:

- suppose under union there are low barriers to trade and large markets; a productive new Scottish firm takes advantage of this situation to expand; as part of this expansion it makes use of London’s comparative advantage in supplying head office services and moves it’s management and R&D divisions to London, keeping its call centre in Scotland

- under independence barriers to trade are higher; the productive new Scottish firm cannot expand as much; so the overall output of the Scottish & rUK economies is lower; but this is London’s loss as the (smaller) firm stays in Scotland with its high quality management and R&D divisions providing high status employment;

As the Treasury say, the border effect also applies to migration flows as well as trade flows. I have also written about migration and population: migration over the Scottish-English border is currently roughly balanced, but that this is an atypical situation by comparison with the 20th century. Even with balanced migration it is possible that Scotland loses out and could benefit from a reduction in these gross flows: this would be the case if these flows represented a net export of human capital from Scotland. Perhaps we export the brightest and best of our young people to the head offices of London, and import middle managers to run branch offices and pensioners to enjoy the views? Demographics also demand that Scotland cannot do with only balanced flows anyway: it needs “net imports” of young people. This may be increasingly unlikely within the UK if the political centre is dragged UKIP’s way.

To summarise, the critique of the border effect is fatuous and confuses a discussion of mechanisms with economic forecasts. The border effect is real and, all other things equal, it is a cost of independence which should not be rubbished. However, all other things are never equal, and if low barriers to trade mean that Scotland is exporting its productive capacity south, then the possibility exists that the border effect could be part of the reasons for independence.

And remember, HMT are currently working for political masters who want an In/Out referendum of the EU. The border effect applies there too.

Sunday, 1 September 2013

End August Links

# Simon Wren-Lewis and Paul Krugman describe the objectivity of analysis produced by the civil service in assessing Gordon Brown's 5 tests for joining the Euro. I think it's fair to say that the positions taken by civil servants in producing the Scotland Analysis series for the UK Government and the various Scottish Government papers have been much less impartial.

# Noah Smith thinking in thought experiments: Does private sector net saving necessitate government net borrowing? A trivial example, but this is the way thinking should be done.

# Why savers can't have nice things: it's all about time travel; Why @saveoursavers are doomed, & Depressions are bad for debtors and creditors, and workers and bosses

# Another North/South divide in the UK

# John Kay's speech at Glasgow University transcript: "Here we come up against one of the most serious problems of Scottish business, the drain of Scottish business and Scottish headquarters out of Scotland over 20, 30, 40 years. How much of that is due to Scotland’s membership of the United Kingdom and how much would have happened anyway in a world in which London is a major financial and business centre is an open question. But certainly, Scotland has not been able to adopt policies of retaining corporate headquarters within its boundaries in ways that it might have been able to do as an independent country." An important question about how constitutional set-up can influence economic outcomes.

# Great comment from Simon Wren-Lewis on Tory macroeconomic policy: The wrong sort of recovery

# This needs to be expanded upon: I have sympathy with the view that this might be true, but I need a theory for why it's true; simply stating it is not enough. "Scotland is a surprisingly elitist society where a relatively small number of people own land, run businesses, own wealth, stand for election and run government. The result is a deep-seated belief that ordinary Scots cannot own and run things, don’t want to own and run things and indeed that it hardly matters who does. It matters. It matters so much that talented folk still leave Scotland instead of pushing for fundamental change. Well-intentioned public servants scour the universe for an explanation of the Scottish Effect (where Scots health is consistently worse than English counterparts in areas with similar levels of deprivation). Perhaps the answer is simple. Perhaps the sheer stultifying burden of disempowerment has finally caught up with us all." This is important not just for Scottish Independence and the referendum, it also has strong message for the economics of inequality: inequality is usually deemed to be bad because the poor have a higher marginal utility of consumption (this reason has also been augmented with newer theories with utility over status or rank). But the quote also hints at negative impacts upon human capital development i.e. supply side impacts of inequality; and how inequality impacts upon self-identity which has knock-on impacts on supply ("we cannae dae it", where "we" means Scots).

# Krugman's 'Banks and the monetary base' made sense to me; but then so did Interfluidity's 'Banks and macroeconomic models'; and even Steve Keen's 'The reductionism stops here'. And they can't all be right...

# Self publicity!

# For future reference: Final version of Tyler Cowan's International Trade class reading list

# Noah Smith thinking in thought experiments: Does private sector net saving necessitate government net borrowing? A trivial example, but this is the way thinking should be done.

# Why savers can't have nice things: it's all about time travel; Why @saveoursavers are doomed, & Depressions are bad for debtors and creditors, and workers and bosses

# Another North/South divide in the UK

# John Kay's speech at Glasgow University transcript: "Here we come up against one of the most serious problems of Scottish business, the drain of Scottish business and Scottish headquarters out of Scotland over 20, 30, 40 years. How much of that is due to Scotland’s membership of the United Kingdom and how much would have happened anyway in a world in which London is a major financial and business centre is an open question. But certainly, Scotland has not been able to adopt policies of retaining corporate headquarters within its boundaries in ways that it might have been able to do as an independent country." An important question about how constitutional set-up can influence economic outcomes.

# Great comment from Simon Wren-Lewis on Tory macroeconomic policy: The wrong sort of recovery

# This needs to be expanded upon: I have sympathy with the view that this might be true, but I need a theory for why it's true; simply stating it is not enough. "Scotland is a surprisingly elitist society where a relatively small number of people own land, run businesses, own wealth, stand for election and run government. The result is a deep-seated belief that ordinary Scots cannot own and run things, don’t want to own and run things and indeed that it hardly matters who does. It matters. It matters so much that talented folk still leave Scotland instead of pushing for fundamental change. Well-intentioned public servants scour the universe for an explanation of the Scottish Effect (where Scots health is consistently worse than English counterparts in areas with similar levels of deprivation). Perhaps the answer is simple. Perhaps the sheer stultifying burden of disempowerment has finally caught up with us all." This is important not just for Scottish Independence and the referendum, it also has strong message for the economics of inequality: inequality is usually deemed to be bad because the poor have a higher marginal utility of consumption (this reason has also been augmented with newer theories with utility over status or rank). But the quote also hints at negative impacts upon human capital development i.e. supply side impacts of inequality; and how inequality impacts upon self-identity which has knock-on impacts on supply ("we cannae dae it", where "we" means Scots).

# Krugman's 'Banks and the monetary base' made sense to me; but then so did Interfluidity's 'Banks and macroeconomic models'; and even Steve Keen's 'The reductionism stops here'. And they can't all be right...

# Self publicity!

# For future reference: Final version of Tyler Cowan's International Trade class reading list

Sunday, 11 August 2013

Population Records

Last week the General Register Office for Scotland released figures that showed Scotland’s population had reached a record high (although the growth rate, far from breaking any records, has slowed). The population overall continues to age, but births have increased and Scotland has attracted net migration both from the rest of the UK and from the rest of the world.

Human capital is likely an important determinant of long-term economic success, since labour is obviously an input into production. Conversely, relative productivity is likely an important determinant of the direction of net migration and other demographic statistics: we could imagine that a small open economy offers a wage conditional on productivity of other factors, and attracts a corresponding labour force to equalise marginal product of labour; and therefore net migration flow indicates higher productivity of these other factors. Whether economic success determines relative demographics or vice versa, these statistics clearly co-vary and looking at the outcome of relative migration can tell us about the outcome of relative economic performance.

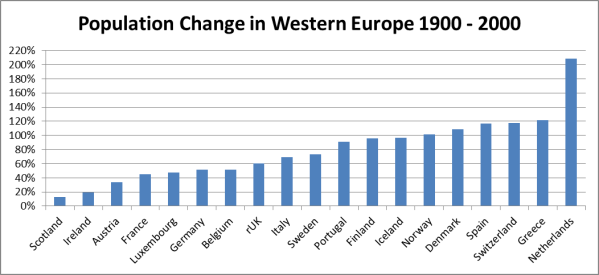

Over the 20th century, Scotland did terribly on net migration and population growth[1] (though somebody has to be at the bottom!). The closest “challenger” to Scotland was Ireland who can be said to share an “emigration technology” with Scotland as regards emigration to USA/Canada/Australia/New Zealand: the English language. Scotland’s population growth was worse than Ireland’s, and much worse than rUK’s – who also shared this English language “technology”, and who should have shared the same government policy framework. Within UK now, approximately 800,000 Scots live in rUK against on approximately 400,000 from rUK living in Scotland.

However, since 1999 Scotland has done better: in particular net flows across the Scotland-England border are now approximately balanced[2], and Scotland reversed its population decline with in-migration from Eastern Europe over 2000-10. Last week’s statistics demonstrate that in-migration remains favourable.

Is Scotland’s improved demographic performance related to achieving limited self-government with the advent of devolution in 1999? Is this a spurious association? Does it indicate that there was poor economic governance up until devolution, but that we are now in an optimum arrangement? Or perhaps it indicates that control over institutions is beneficial, and more control (e.g. independence) would be even more beneficial?

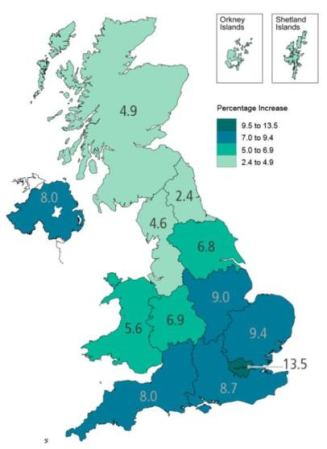

The Office for National Statistics map of UK population increase[3] can be read in support of the interpretation that proximity to power is related to population growth (and presumably also to net migration, and to relative economic performance). The fall-off in the rate of population increase as distance from London increases is evident (high fertility in Northern Ireland excepted), and perhaps Holyrood is the only reason for Scotland’s rate being above that of the North West and North East of England? Interestingly it is also the case that, within Scotland, Edinburgh and the east saw population increases, while population fell in the west.

First posted at http://esrcscotecon.com/2013/08/11/population-records/#more-433

[1] Country data from GapMinder, Scottish data from Wikipedia (rUK = UK – Scotland). [2] Chart 4.09 Fiscal Commission WG http://www.scotland.gov.uk/Resource/0041/00414291.pdf [3] As tweeted by the BBC’s Mark Easton

[1] Country data from GapMinder, Scottish data from Wikipedia (rUK = UK – Scotland). [2] Chart 4.09 Fiscal Commission WG http://www.scotland.gov.uk/Resource/0041/00414291.pdf [3] As tweeted by the BBC’s Mark Easton

Thursday, 8 August 2013

Inflated emphasis in the news

From the BBC: "The Bank of England has outlined its strategy for future interest rate changes - and it is likely to mean further pain for savers, but continued cheap mortgage rates."

But in the self selected set of economics blogs that I read, yesterday's Inflation Report represented a tightening of monetary policy. The BoE is "targeting high unemployment", and using a poorly designed system (the specified "knockouts" would have suggested that the BoE tighten policy in the middle of 2008 - this makes them almost self-evidently wrong-headed indicators). And given that the market fell and the pound rose on the news, it's likely that these views represent something like the consensus view in financial markets.

So given that creditors tend to benefit from tighter monetary policy and borrowers from looser monetary policy, and yesterday represented a tightening of monetary policy, why has much of the media focused on complaints from greeting-faced savers groups?

But in the self selected set of economics blogs that I read, yesterday's Inflation Report represented a tightening of monetary policy. The BoE is "targeting high unemployment", and using a poorly designed system (the specified "knockouts" would have suggested that the BoE tighten policy in the middle of 2008 - this makes them almost self-evidently wrong-headed indicators). And given that the market fell and the pound rose on the news, it's likely that these views represent something like the consensus view in financial markets.

So given that creditors tend to benefit from tighter monetary policy and borrowers from looser monetary policy, and yesterday represented a tightening of monetary policy, why has much of the media focused on complaints from greeting-faced savers groups?

Sunday, 7 July 2013

Large Markets, Gains from Trade, and a Puzzle

The latest paper in the UK Government’s Scotland Analysis series was released last week by the Department for Business, Innovation and Skills. The BIS paper describes the benefits of a large market for business, workers and consumers. This detail is fine: economists typically do believe that trade is usually mutually beneficial and so barriers to trade, such as a national border, are damaging at the margin. Indeed, I have written a paper on the economics of independence for Catalonia from Spain (see Comerford, Myers & Rodriguez Mora (2013)) in which this is the very mechanism at work. Sub-national entities appear to trade much more with the other parts of the nation state of which they are a part than independent nations do with their neighbours. Sharing a state seems to be a trade enabling technology, and this trade is valuable, with positive effects on welfare. Preliminary estimates (using the methodology of Comerford, Myers & Rodriguez Mora (2013)) of the welfare cost to Scotland of creating a national border between Scotland and rUK are of the order of 5% of Scotland’s GDP.

Successful small independent nations engage in more international trade than their larger counterparts. So perhaps small nations develop institutions that are conducive to international trade, and their international borders cause smaller frictions than the international borders of larger nations (for whom international trade is less important)? However, model calibrations do not suggest that the extra trade that we see in the data is due to a greater ability to engage in such trade: the international borders of small nations seem to cause frictions that are equivalent to the frictions caused by the international borders of larger nations. Instead small nations seem to be compelled to engage in more international trade due to the small size of their domestic markets. Therefore we cannot expect the reallocation in Scotland’s trade from rUK to the rest of the world to produce welfare effects that mitigate the 5% estimated cost – these reallocations are already assumed in that calculation.

This is starting to sound conclusive: trade is good and eliminating international borders is a mechanism that generates more trade. However, if this were the case, then we might expect to see a systematic positive relationship between country size and wealth. We see no such relationship in cross country data (see Rose (2006)). A quick back of the envelope calculation of the elasticity of per capita GDP with respect to national population using 2005 data from the World Bank shows that any relationship that there is between population and wealth would seem to be negative[1].

Country

Grouping

|

Elasticity

of GDP per Capita w.r.t. Population Size

|

Whole World

|

-0.154***

|

OECD

|

-0.058

|

EU15

|

-0.139*

|

Perhaps the importance of trade is overstated? This is possible but the calibrations used in Comerford, Myers & Rodriguez Mora (2013) are consistent with the latest estimates and advanced methodologies in the literature (see Arkolakis, Costinot & Rodriguez-Clare (2012) and Simonovska & Waugh (2013)). If the positive effects of trade are real, then conditional on the real wealth distribution of countries, this implies that smaller countries must compensate: they appear to have higher intrinsic productivity (i.e. a higher productivity before considering the impact of trade). Comparable results to the above table but now for the elasticity of this intrinsic productivity with respect to national population are:

Country

Grouping

|

Elasticity

of intrinsic productivity w.r.t. Population Size

|

Whole World

|

-0.334***

|

OECD

|

-0.221***

|

EU15

|

-0.293***

|

If we could interpret these figures as representing a causal relationship, then they suggest that Scotland would more than double its intrinsic productivity on achieving independence[2], an effect which dwarfs the 5% estimated cost of a border with rUK. However, we cannot interpret these numbers as causal and we can imagine clear endogenous mechanisms that may generate such observed relationships: perhaps productive regions, being already wealthy, choose independence whereas less productive regions, who see their wealthier neighbours, choose to join a larger state; this would give the appearance of small states being associated with high productivity. On the other hand, we may also imagine mechanisms that would enhance productivity in small independent states when compared with the peripheral regions of larger states: perhaps there are spillovers from having head office functions rather than branch offices, and head offices preferentially locate to be close to decision makers at nation state level rather than local authority level; perhaps simply economic governance works better in smaller states.

Whatever explains the discrepancy between the predictions of models with Gains From Trade, and the observed relationship between country size and wealth, I do not mean to suggest that net benefits for Scotland from independence are to be expected. I simply point out that the BIS paper’s focus on the costs from the loss of the UK single market is a partial analysis, and one which, in particular, cannot account for the success of small open economies.

[1] The results in the table should be interpreted as e.g. countries in the EU15 with twice the population of their peers have, on average GDP per capita that is 14% lower than in these smaller peers. *, ** & *** respectively represent significance at 10%, 5% & 1% levels in these naïve regressions. For these results to represent a true statistical relationship, it would need to be the case that log Population was causal for log GDP per capita, but that log GDP per capita was not causal for log Population. This is clearly not satisfied, so what we are looking at is simple correlations in observables rather than any structural relationship.

[2] Change in intrinsic productivity ~ exp(-0.3*ln(5million/60million)) > 2

Monday, 1 July 2013

End June Links

# I've been interested in "critical transitions" before, and recently read Nassim Taleb's book Antifragility (essentially about concave impact from risk realisations, combined with fat tailed risks), but this Less Wrong post suggests a link: Anticipating Critical Transitions.

# Miles Kimball links to posts on negative nominal interest rates including this from Willem Buiter: The wonderful world of negative nominal interest rates, again

# The basic thesis of Iain MacWhirter's 'Low pay is a cause of stagnation, not a consequence of it' is pretty standard. But the conclusion gets to the crux of the economic case for independence. Rather than the analysing the pounds and pence of the current fiscal situation, the debate should be focussed on whether the following is correct, and if so, the constitutional settlement that will best address it:

"Scotland has to reconnect with its manufacturing past. Scotland was one of the most advanced industrial civilisations in the world a century ago, a cradle of the industrial revolution. There was nothing inevitable about Scotland's industrial collapse – it was the result of economic policies that allowed Britain to become grossly over centralised in the South East of England.

And it's still happening, with the London Mayor, Boris Johnson, launching his “Vision for 2020” this week, demanding even more national wealth being poured into the infrastructure of the metropolis, in order to make one of the most congested regions on the planet even more congested.Whatever happens in the Scottish independence referendum, the priority has to be preventing this relentless southern vortex of wealth and power from sucking the economic life out of Scotland and turning this country into a tartan theme park. Scots may be unconvinced about the merits of formal independence, but there is a greater understanding today about the causes of Scotland's decline than ever before, and a greater determination to reverse it. That should be the top line on the manifesto of every party in Scotland in 2014."

Gerry Hassan's 'Living on an Island: Scotland and the London Question' is another good piece on a similar theme.

# I really need to look at and understand Steve Keen and this post looks like a good place to start: Gasping in Krugman's ocean of theory

# Another excellent post from Interfluidity that rationalises the accumulation of scale and interconnectedness in regulated finance, and the accumulation of information in regulated surveillance, as consequence of organisational evolution - and in particular the role that regulation plays in this evolution.

# Miles Kimball links to posts on negative nominal interest rates including this from Willem Buiter: The wonderful world of negative nominal interest rates, again

# The basic thesis of Iain MacWhirter's 'Low pay is a cause of stagnation, not a consequence of it' is pretty standard. But the conclusion gets to the crux of the economic case for independence. Rather than the analysing the pounds and pence of the current fiscal situation, the debate should be focussed on whether the following is correct, and if so, the constitutional settlement that will best address it:

"Scotland has to reconnect with its manufacturing past. Scotland was one of the most advanced industrial civilisations in the world a century ago, a cradle of the industrial revolution. There was nothing inevitable about Scotland's industrial collapse – it was the result of economic policies that allowed Britain to become grossly over centralised in the South East of England.

And it's still happening, with the London Mayor, Boris Johnson, launching his “Vision for 2020” this week, demanding even more national wealth being poured into the infrastructure of the metropolis, in order to make one of the most congested regions on the planet even more congested.Whatever happens in the Scottish independence referendum, the priority has to be preventing this relentless southern vortex of wealth and power from sucking the economic life out of Scotland and turning this country into a tartan theme park. Scots may be unconvinced about the merits of formal independence, but there is a greater understanding today about the causes of Scotland's decline than ever before, and a greater determination to reverse it. That should be the top line on the manifesto of every party in Scotland in 2014."

Gerry Hassan's 'Living on an Island: Scotland and the London Question' is another good piece on a similar theme.

# I really need to look at and understand Steve Keen and this post looks like a good place to start: Gasping in Krugman's ocean of theory

# Another excellent post from Interfluidity that rationalises the accumulation of scale and interconnectedness in regulated finance, and the accumulation of information in regulated surveillance, as consequence of organisational evolution - and in particular the role that regulation plays in this evolution.

Friday, 14 June 2013

A speculative idea about currency unions

Angela Merkel wants unemployed Europeans to move, this after Paul Krugman pointed out the dangers that this has within a currency union in the absence of fiscal integration. A country gets into trouble: recession and high unemployment leads to budget deficits and a run up in the government debt levels. If the population then leaves to work elsewhere there will be no-one to restore the fiscal balance and, ultimately, repay this debt. Can currency unions actually work then?

How about this for an idea: the central bank guarantees a level of nominal GDP growth at the level of the whole union. States within the union issue bonds denominated in the currency of the union, but indexed to their own relative level of nominal GDP - the level of which is not guaranteed. This means that if bonds are issued to cover recession induced deficits but the young then emigrate, the level of the debt will be written down in respect of the relative fall in nominal GDP.

The only issue I can see is ensuring the objectivity of the entity which reports the relative level of the nominal GDPs of the countries within the union.

Related: the more I think about it, the less convinced I am about a Sterling Zone for a post independence Scotland. I'm becoming more pro Eurozone again - it's a much more symmetric grouping of countries, and to first order it is, like the USA, a closed economy. But there are all sorts of reforms needed: hence the ideas!

How about this for an idea: the central bank guarantees a level of nominal GDP growth at the level of the whole union. States within the union issue bonds denominated in the currency of the union, but indexed to their own relative level of nominal GDP - the level of which is not guaranteed. This means that if bonds are issued to cover recession induced deficits but the young then emigrate, the level of the debt will be written down in respect of the relative fall in nominal GDP.

The only issue I can see is ensuring the objectivity of the entity which reports the relative level of the nominal GDPs of the countries within the union.

Related: the more I think about it, the less convinced I am about a Sterling Zone for a post independence Scotland. I'm becoming more pro Eurozone again - it's a much more symmetric grouping of countries, and to first order it is, like the USA, a closed economy. But there are all sorts of reforms needed: hence the ideas!

Sunday, 9 June 2013

Passed...

... my PhD!

Some celebratory tunes:

Secova - Kindle

Also I am profiled in The Actuary magazine. Bet Paul Krugman cannae say that!

Some celebratory tunes:

Secova - Kindle

Also I am profiled in The Actuary magazine. Bet Paul Krugman cannae say that!

Tuesday, 4 June 2013

Independence as a “Real Option”: Explaining the campaign so far

A common refrain from pro-union campaigners has been for the SNP to provide detail around “what independence would look like”. To the extent that a vision of an independent Scotland has been provided by the SNP (not necessarily by Yes Scotland), differences with the status quo have been minimised.

The vision that the SNP have articulated has suggested a great deal of continuity: the Common Travel Area between the UK and the Republic of Ireland provides a model of continuing open borders; maintenance of the monarchy; continued membership of the EU and NATO; an emphasised “Social Union”; evidence that maintenance of the level of tax-and-spend is affordable; and, especially, the favoured option of a Sterling Union. This vision has led to the response from some on the pro-independence side that this does not optimally use the levers of independence, but it has also seemingly provoked the pro-union side (who might be expected to view this vision of continuity as second-best after their preferred union option) who also argue against this vision partially on the grounds that it would fail to deliver “genuine freedom”! Can we economically rationalise these positions?

Assume that, unless explicitly changed, “things” (by which I mean essentially everything) will continue to be the “same” after independence. What then is the value of independence? Independence could be viewed under the lens of real option theory: a real option is “the right — but not the obligation — to undertake certain … initiatives”. Under union, the Scottish Parliament cannot award itself new powers and “things” will of course continue to be the “same”. Under independence, “things” are the “same” until such time as, presumably, we don’t like this “same” path for “things” and the Parliament exercises this option and decide to change these “things”. Options are always valuable (since they represent a right but not an obligation). This means that if the SNP can make the case that “things” will continue to be the “same” after independence, and that independence represents an “option” to change things then, by this logic, independence is objectively optimal.

This is a potential explanation for the Independence-lite vision of the SNP which essentially points to how similar “things” will be after independence. It presents a scenario under which independence is almost objectively optimal. This is also a potential explanation for the vociferous objections to this vision from those opposed to independence. To counter the SNP vision, the pro-union campaign has to convince voters that “things” will not be the “same” after independence and they essentially have three channels in which to do this:

- the first is to assert that “things” will not be the “same” even under the SNP’s vision because of, for example, transition costs or risk exposures;

- the second is to claim that the SNP’s vision is impossible to implement, and so we cannot keep “things” the “same” (as in the HM Treasury paper on a Sterling Union);

- and the third channel is to argue that “things” won’t be the “same” because the option will be exercised immediately: an independent Scotland will choose “genuine freedom” instead of keeping “things” the “same”.

This sums up many of the campaign dynamics so far: the logical optimality of independence under the assumption of keeping “things” the “same” perhaps explains the SNP’s Independence-lite vision; And the third channel available to the pro-union campaigners perhaps explains the enthusiasm with which they point out that constrained independence does not represent real independence.

Originally posted on esrcscotecon

Monday, 3 June 2013

End May Links

Nick Rowe's Monetary stimulus vs financial stability is a false trade-off is a great description of general equilibrium outcomes as against the micro-mechanisms that they arise from: lower interest rates may induce me to save less from my (exogenous) income; but at the macro level, lower interest rates do not imply that there will be a lower savings rate applied to the (endogenous) national income.

Simon Wren-Lewis and George Kerevan discussing, in completely different ways, the rise of UKIP. My favourite UKIP post though was this spoof from the Daily Mash.

Paul Krugman makes the point that needs made again and again: to the extent that something which we might call "austerity" is needed, this austerity should be about working harder and not seeing the rewards in terms of higher consumption i.e. more work, less play; it should not be about mass unemployment.

Fascinating: French fertility fall

Simon Wren-Lewis and George Kerevan discussing, in completely different ways, the rise of UKIP. My favourite UKIP post though was this spoof from the Daily Mash.

Paul Krugman makes the point that needs made again and again: to the extent that something which we might call "austerity" is needed, this austerity should be about working harder and not seeing the rewards in terms of higher consumption i.e. more work, less play; it should not be about mass unemployment.

Fascinating: French fertility fall

Thursday, 23 May 2013

Concentrating economic activity in London

I've posted my first blog post at ESRC The Economics of Constitutional Change blog. It's entitled The decision to concentrate economic activity in London. Comments should be left here though as we're not accepting comments on the ESRC site.

Monday, 6 May 2013

End April Links

# Another good defence of the economics that I understand from Noah Smith: What is an economic equilibrium?

# "Paying more in" than you take out, unless you're unfortunate, is fundamental not only to insurance but also to communitarian and cooperative society. As Chris Dillow says, some people need reminded of this, including the Labour party it seems.

# I probably need to link to something Thatcher related. Chris Dillow describes Thatcherite roots of the crisis

# The stupid cruelty of the creditor

# Edinburgh doing well: Scotland's tech start-up capital?

# Another outstanding post from Interfluidity, The mother of invention. A quote: "

# "Paying more in" than you take out, unless you're unfortunate, is fundamental not only to insurance but also to communitarian and cooperative society. As Chris Dillow says, some people need reminded of this, including the Labour party it seems.

# I probably need to link to something Thatcher related. Chris Dillow describes Thatcherite roots of the crisis

# The stupid cruelty of the creditor

# Edinburgh doing well: Scotland's tech start-up capital?

# Another outstanding post from Interfluidity, The mother of invention. A quote: "

Abundance, ultimately, is a choice variable for the political class. “We” are presented with a devious choice, a Faustian seduction. We can choose abundance, for ourselves, by maintaining a distribution under which a relatively small fraction of humanity claims a sufficiently large share of world purchasing power that the economy’s capacity to produce will remain safely in excess of that group’s needs. Or we can choose scarcity, by distributing purchasing power widely enough to put our productive capacity under pressure, leaving all of us, even the affluent, at risk of actual shortage.

If we choose the abundance, we can expect Tyler Cowen’s “Great Stagnation” to continue. Technology will stagnate, because purchasing-power weighted necessity is the mother of invention, but people with needs have little purchasing power while people with purchasing power have trivial needs. If we choose scarcity, we take a risk. We may fail, and end up impoverished relative to where we (some of us) might have been, had we chosen the more conservative path. But purchasing-power-weighted necessity is the mother of invention, and in the past, mass affluence has inspired extraordinary innovation in pursuit of the mass dollar. If you believe in the power of capitalism and technology, then you should favor choosing scarcity, both for your own benefit (robots, yay!) and to expand the “we” by whom some level of abundance might plausibly be claimed."

Sunday, 28 April 2013

Sterling, The Big One

It's been the big issue of the past week, so let's discuss some of the currency options for an independent Scotland and the advantages and disadvantages of each.

1) Join the Euro

Won't fly politically and doesn't sound optimal until there are a decent set of institutions for it to operate under. Barely worth considering at the moment, and nobody seems to be advocating it, but it may be a future aspiration if e.g. a transfer union can be agreed. In particular it is a much more symmetrical arrangement than a Sterling Zone, with Germany constituting approximately 30% of Eurozone GDP relative to rUK's 90% of Sterling zone GDP.

2) A Scottish currency

Will probably put people off in the referendum and there are real transaction costs involved for trade. There are also transitional issues (i.e. contracts denominated in Sterling will take a while to expire: a debt in Sterling and an income in a Scots currency would lead to a large exchange rate risk). May expose the rest of the economy to the 'resource curse' if oil exports cause an overvalued currency and other industries are therefore uncompetitive. Would allow monetary policy to be 100% weighted towards Scotland. Advocated by Jim Cuthbert and the Jimmy Reid Foundation.

3) Use Sterling without monetary union

This is feasible but means abdicating monetary policy levers entirely: you import the monetary policy of the country whose currency you are using. No lender of last resort in the currency you are shadowing.

Given the flaws that these three options clearly have, let's focus on the issue of the week:

4) Use Sterling in a monetary union with rUK

This is the Scottish Government's preferred option, and in what looks like a bit of pre-negotiating, something that the UK government says will not work. Alastair Darling claims:

"that keeping the sterling as currency would simply make no sense and much less worth to bother with independence because the country would still be in an economic union with the rest of the United Kingdom which would be a mini-version of the eurozone. Furthermore, Scotland would not have any say in interest rates if it would have a common currency with a foreign country because the latter would not set the interest rates according to the interest of Scotland. What Darling is trying to say is that breaking off from the union and keeping the pound as currency would undermine an eventual Scottish independence because the country would need to play by the rules set from outside."

This argument would hold more weight if anyone was actually credibly proposing e.g. a federal UK. To say that the independence that would be achieved as an independent country within a monetary union is not 'real independence' is perhaps an argument that a proponent of independence can plausibly make: but it makes no rational sense (though it may make campaigning sense) coming from the No campaign. There would be more autonomy for Scotland under the fiscal arrangements of a currency union than there would be under the current situation. Given the large combined support for independence or more devolution, the constraints of a currency union may be something that is consistent with the preferences of the electorate.

And there would be constraints. A government with the technological/institutional feasibility of running a primary surplus, in a country with its own currency, cannot go bankrupt: whatever its debt situation it can always devalue and repudiate the debt using inflation rather than default. However, within a currency union, this instrument may be needed for one member but not the other parties. In this case this policy lever disappears because the other countries are not willing to accept the devaluation, and default risk arises. To minimise this risk, a deal would have to be struck on deficit limits, but I do not accept that such a deal has to cover government spending levels: in the language of an economics class, it's (G-T)/Y that matters, and not G/Y or T/Y separately. Therefore, if Scotland wishes Scandinavian style levels of tax and spend, whilst rUK leans more towards the US style levels, then I don't see any reason why this is incompatible with monetary union so long as both are running similar government deficits/surpluses. Once a fiscal pact on deficit limits had been agreed, then so long as the government had not reneged on the terms of this agreement, the central bank would be obliged to act as lender of last resort to the government.