# Secular Stagnation As Wising Up

# Government borrowing and long-term interest rates: a natural experiment

# Bitcoin isn’t the future of money — it’s either a Ponzi scheme or a pyramid scheme

# What Assumptions Matter for Growth Theory? is the best summary of the "Mathiness" discussion in econ blogs

# Glick & Rose The currency union effect on trade: Redux: it used to be estimated and presumed that currency union had a strong effect on trade, but recent empirical work has found much weaker effects. Basically the data hint that there are positive effects, but the size of any such effect is a strong function of the econometric technique used, and so we cannot say with any confidence that there is much of an effect on trade from CU.

# 2 pieces of great news from the Netherlands:

- Dutch court’s climate ruling may force other states to cut emissions – or else

- Dutch city of Utrecht to experiment in citizen’s income

# Not such good news on the effectiveness of energy efficiency when done in reality rather than under ideal conditions: A new study looks at federal energy-efficiency efforts — and the results are grim

# Andrew ZP Smith asks, among other things, if wind energy is actually subsidised: "The chief assistance for onshore windfarm operators comes in the form of top-up payments from bill-payers, above what the operators receive from selling their electricity in the wholesale markets. ... An electricity grid tends to rank different generators in order of marginal cost, prioritising the cheapest forms of generation. ... Cheap electricity is brought online first, and the plants with the highest marginal generation cost are saved till last. ... Wind is never the most expensive fuel on the grid, because its fuel is free. The cost of wind power is almost entirely in construction; marginal generation cost is next to nothing. Therefore when the wind blows and power is generated, it knocks out the most expensive generator (and whether that’s coal or gas, depends on their relative prices, the carbon price, and the relative efficiency of the generators) and it lowers prices across the whole market. Previous research in Germany and Spain has found that these cost reductions outweigh the revenue support paid to wind. Wind is not subsidised in those two countries – indeed, quite the reverse, wind lowers total costs for consumers."

# Evidence on the costs of Brexit? Campos, Coricelli, & Moretti conduct econometric exercises on Norway (which was able to join the EU in 1994, but chose not to) and the other 1994 candidate countries (who did join) Sweden, Finland and Austria. They find that the decision not to join the EU has reduced Norway's productivity by 6%.

# It's not often Celtic and Scottish football get a mention on VoxEU! Dominance in football: An application of Sutton’s theory of endogenous sunk costs

# People often say that lefties support Keynesian demand management because they support big government. Nick Rowe makes a good point that this doesn't make sense: "My beliefs about the optimal size of government don't matter for my beliefs about fiscal policy. My belief that the size of government matters and that there is an (interior*) optimum does matter for my beliefs about fiscal policy. It's why I'm against it." i.e. belief in big government should bias you against Keynesian demand management (all else equal).

# This Diane Coyle post is a bit rambling, but the maps are cool, there are some links that I should go back to, and it ends with a point that I entirely agree with about CBA for transport projects: "standard cost-benefit analysis does not do a good job when it comes to big infrastructure projects ... because it is a tool for assessing marginal changes, not ones which might involve large non-linearities – behaviour changes or network effects. ... it isn’t about saving 20 minutes on your journey time to increase the amount of time you can spend in a meeting at the other end."

Tuesday, 30 June 2015

Friday, 26 June 2015

Is fiscal austerity contractionary under floating exchange rates?

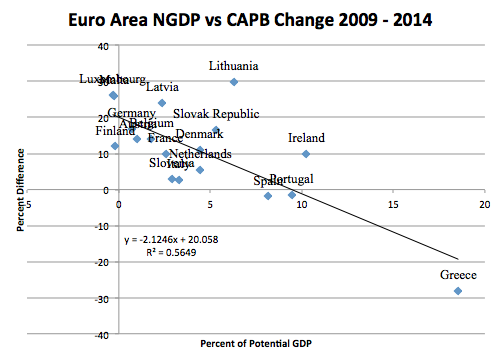

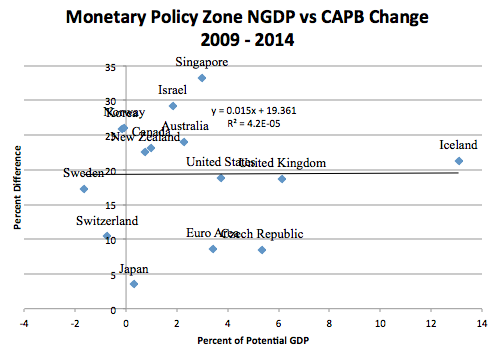

Nick Rowe points to Scott Sumner pointing to research by Mark Sadowski: basically austerity is strongly associated with weaker economic activity in the Eurozone (so country implementing it does not have control over monetary policy with which to offset the fiscal austerity), but not associated with weaker economic activity in countries with their own currency.

Graphs pinched from Scott Sumner's blog:

# Eurozone/no independent monetary policy -

# Independent monetary policy -

Scott Sumner uses this result to claim support for the "Market Monetarist" position (that monetary offset is always possible and so there is no reason to use fiscal policy), over the Keynesian position (that monetary policy is exhausted when interest rates reach their ZLB and fiscal policy should be used). The application of this result to the UK might be that the combination of austerity (to eliminate the government's budget deficit) and expansionary monetary policy (to boost the economy) is a perfectly coherent and practical policy choice.

Is this a valid conclusion to draw? As Nick Rowe says "It's 6 days now, which is a long time in the blogosphere. I have seen posts about who said what about who said what. What I want to see are posts that interpret those correlations. And other interpretations/explanations are always possible (though econometricians bravely try to minimise the number of plausible interpretations). How would you explain them?"

I would guess that an important explanation here is relative devaluation: Using data from BIS, there is a strong negative correlation between the degree of austerity and the devaluation experienced for the floating rate countries. If devaluation is associated with economic expansion (which seems plausible), but under floating exchange rates devaluation occurs at the same time as fiscal austerity, then austerity could be ceteris paribus contractionary, but we would not see the actual contraction under floating rates - so e.g. in Iceland we see austerity (contractionary) and devaluation (expansionary) and overall not much impact. In Eurozone countries we see only the ceteris paribus contractionary effect of fiscal austerity.

The problem for the policy conclusions that you might draw if this is the explanation is that in times of depression, not everyone can devalue against everyone else - it is by definition a zero sum game. So devaluation worked well for Iceland which was small and could achieve lots of relative price movement against e.g. the US, but it cannot work in general. There's still a need for fiscal policy - especially in relatively large currency zones like UK (which is certainly large relative to the Icelandic Krona).

----------------------------------------------------------

Technical results:

# Regression for eurozone/fixed rate countries. Note negative and significant coefficient for degree of austerity (capb) upon economic performance (ngdp): point estimate = -2.12, p_value = 0.1%

# Regression for floating rate countries. Insignificant relationship (p_value = 88.4%) between degree of austerity and economic performance.

# Adding trade weighted exchange rate movement over the period (xrchg) changes the picture. The correlation between the capb and xrchg variables is -63%, and the observed variation in the combination of the two variables enhances the observed negative effect of austerity upon economic activity. The austerity variable is still not significant but its 95% confidence interval includes the point estimate for the fixed rate eurozone economies.

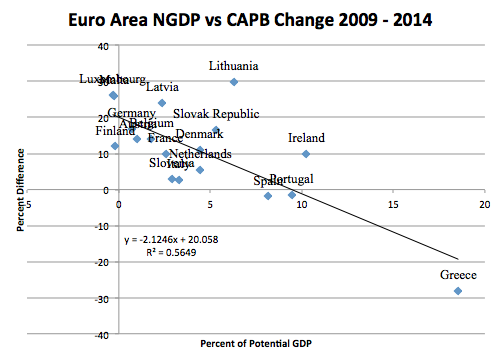

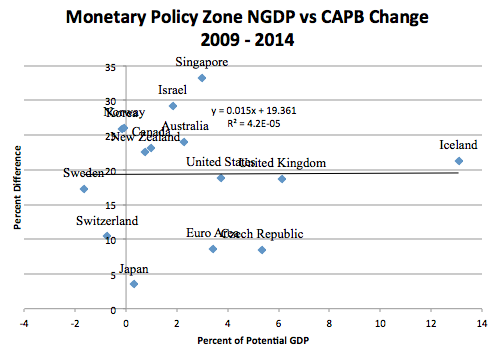

Graphs pinched from Scott Sumner's blog:

# Eurozone/no independent monetary policy -

# Independent monetary policy -

Scott Sumner uses this result to claim support for the "Market Monetarist" position (that monetary offset is always possible and so there is no reason to use fiscal policy), over the Keynesian position (that monetary policy is exhausted when interest rates reach their ZLB and fiscal policy should be used). The application of this result to the UK might be that the combination of austerity (to eliminate the government's budget deficit) and expansionary monetary policy (to boost the economy) is a perfectly coherent and practical policy choice.

Is this a valid conclusion to draw? As Nick Rowe says "It's 6 days now, which is a long time in the blogosphere. I have seen posts about who said what about who said what. What I want to see are posts that interpret those correlations. And other interpretations/explanations are always possible (though econometricians bravely try to minimise the number of plausible interpretations). How would you explain them?"

I would guess that an important explanation here is relative devaluation: Using data from BIS, there is a strong negative correlation between the degree of austerity and the devaluation experienced for the floating rate countries. If devaluation is associated with economic expansion (which seems plausible), but under floating exchange rates devaluation occurs at the same time as fiscal austerity, then austerity could be ceteris paribus contractionary, but we would not see the actual contraction under floating rates - so e.g. in Iceland we see austerity (contractionary) and devaluation (expansionary) and overall not much impact. In Eurozone countries we see only the ceteris paribus contractionary effect of fiscal austerity.

The problem for the policy conclusions that you might draw if this is the explanation is that in times of depression, not everyone can devalue against everyone else - it is by definition a zero sum game. So devaluation worked well for Iceland which was small and could achieve lots of relative price movement against e.g. the US, but it cannot work in general. There's still a need for fiscal policy - especially in relatively large currency zones like UK (which is certainly large relative to the Icelandic Krona).

----------------------------------------------------------

Technical results:

# Regression for eurozone/fixed rate countries. Note negative and significant coefficient for degree of austerity (capb) upon economic performance (ngdp): point estimate = -2.12, p_value = 0.1%

# Regression for floating rate countries. Insignificant relationship (p_value = 88.4%) between degree of austerity and economic performance.

# Adding trade weighted exchange rate movement over the period (xrchg) changes the picture. The correlation between the capb and xrchg variables is -63%, and the observed variation in the combination of the two variables enhances the observed negative effect of austerity upon economic activity. The austerity variable is still not significant but its 95% confidence interval includes the point estimate for the fixed rate eurozone economies.

Friday, 19 June 2015

I think effort is required to be this technically illiterate!

BBC Scotland reports today on a new hydro scheme: "Plans lodged with Dumfries and Galloway Council said the scheme will generate about 700 megawatts a year." Now obviously a scheme that delivered energy output at a rate that was accelerating by 700 MW per year would be fantastic: if initial output was zero, within a decade it could be generating all the electricity used in Scotland (less than 6GW) - but I knew the BBC must have got this wrong and presumably the plans were either for a big 700MW scheme, or for a small scheme that generated 700MWhrs per year. They helpfully provided a link.

In a moment of prevarication, I clicked through and saw that the plans said neither! They actually said 100kW. So the journalist must have converted 100kW to 100kWhrs per hour, then multiplied by approximately 350 days per year, and by approximately 20hrs per day to get 700MWhrs per year, and then reported it as 700MW "a" year.

This is mind blowing semi-competent incompetence!

In a moment of prevarication, I clicked through and saw that the plans said neither! They actually said 100kW. So the journalist must have converted 100kW to 100kWhrs per hour, then multiplied by approximately 350 days per year, and by approximately 20hrs per day to get 700MWhrs per year, and then reported it as 700MW "a" year.

This is mind blowing semi-competent incompetence!

Monday, 1 June 2015

End May Links

# Richard Murphy highlights some interesting research which suggests that tax cuts only promote employment growth if they're directed at the lower end of the household income distribution, with no change on employment if directed towards the top of the income distribution. (Of course I'm only linking to this as confirmation bias - it's the sort of thing I'd like to be true!)

# In terms of SNP policy priorities for Westminster, I agree with Mike MacKenzie's True Grid on Bella: gaining a regulatory and subsidy regime that allows a full exploitation of Scotland's renewable energy resources should be the top priority. The news that the SNP has the chairmanship of the Energy and Climate Change select committee is therefore particularly welcome.

# Wow! No idea is this is feasible or not, but the scale of the idea from ScottishScientist is jaw-dropping: World’s biggest-ever pumped-storage hydro-scheme, for Scotland? Euan Mearns provides some criticism.

# Simon Wren-Lewis provides the best election post-mortem on the macro-economic arguments that played out in the media, and Labour's abject failure in this regard.

# In terms of SNP policy priorities for Westminster, I agree with Mike MacKenzie's True Grid on Bella: gaining a regulatory and subsidy regime that allows a full exploitation of Scotland's renewable energy resources should be the top priority. The news that the SNP has the chairmanship of the Energy and Climate Change select committee is therefore particularly welcome.

# Wow! No idea is this is feasible or not, but the scale of the idea from ScottishScientist is jaw-dropping: World’s biggest-ever pumped-storage hydro-scheme, for Scotland? Euan Mearns provides some criticism.

# Simon Wren-Lewis provides the best election post-mortem on the macro-economic arguments that played out in the media, and Labour's abject failure in this regard.

Subscribe to:

Comments (Atom)